RESOURCES

Stay in the loop with Spencer Logic. Keep up the pace with the latest trends and innovations in trading technology, regulation and more.

Newest Articles

Building Trust at Launch: Compliance, Security, and Regulatory Readiness in a Turnkey Stack

Plublished By: Logic Pulse

January 21, 2026

Top Articles

Building Trust at Launch: Compliance, Security, and Regulatory Readiness in a Turnkey Stack

Trust is the currency of modern brokerage. Compliance infrastructure, onboarding workflows, data security, and regulatory alignment determine whether a broker scales smoothly, faces operational risk, or eventually collapses under scrutiny. This article explains how Spencer Logic’s turnkey stack embeds trust at the foundation level.

January 21, 2026

Turnkey vs. White Label vs. In-House Build: Which Brokerage Model Delivers the Best ROI?

Choosing how to build an FX/CFD brokerage—turnkey, white label, or in-house—determines long-term profitability, operational efficiency, and regulatory viability. This report-style article breaks down the true economics and operational realities behind each model, revealing why the turnkey approach is increasingly the strategic choice for serious brokers.

January 6, 2026

From Zero to Broker in 30 Days — The Spencer Logic Deployment Framework

Building an FX/CFD brokerage is one of the most deceptively complex undertakings in modern fintech. It appears simple: secure MT5 or MT4, find a liquidity provider, choose a CRM, add a KYC provider, integrate payments, and begin onboarding clients. In reality, these elements cannot be stitched together casually. Each component depends on how the others are engineered. Every decision made early in the architecture affects execution quality, risk exposure, regulatory alignment, latency, and even the brokerage’s ability to scale.

December 22, 2025

Turnkey Brokerage Solutions: The Smartest Launch Strategy for Modern FX/CFD Brokers

A turnkey brokerage solution delivers an end-to-end, pre-integrated operational stack—not just a trading platform.

It dramatically reduces launch time from months to weeks by eliminating vendor coordination and integration overhead.

Compared to white labels, turnkey models provide liquidity, KYC, payments, risk tools, and compliance workflows out of the box.

December 9, 2025

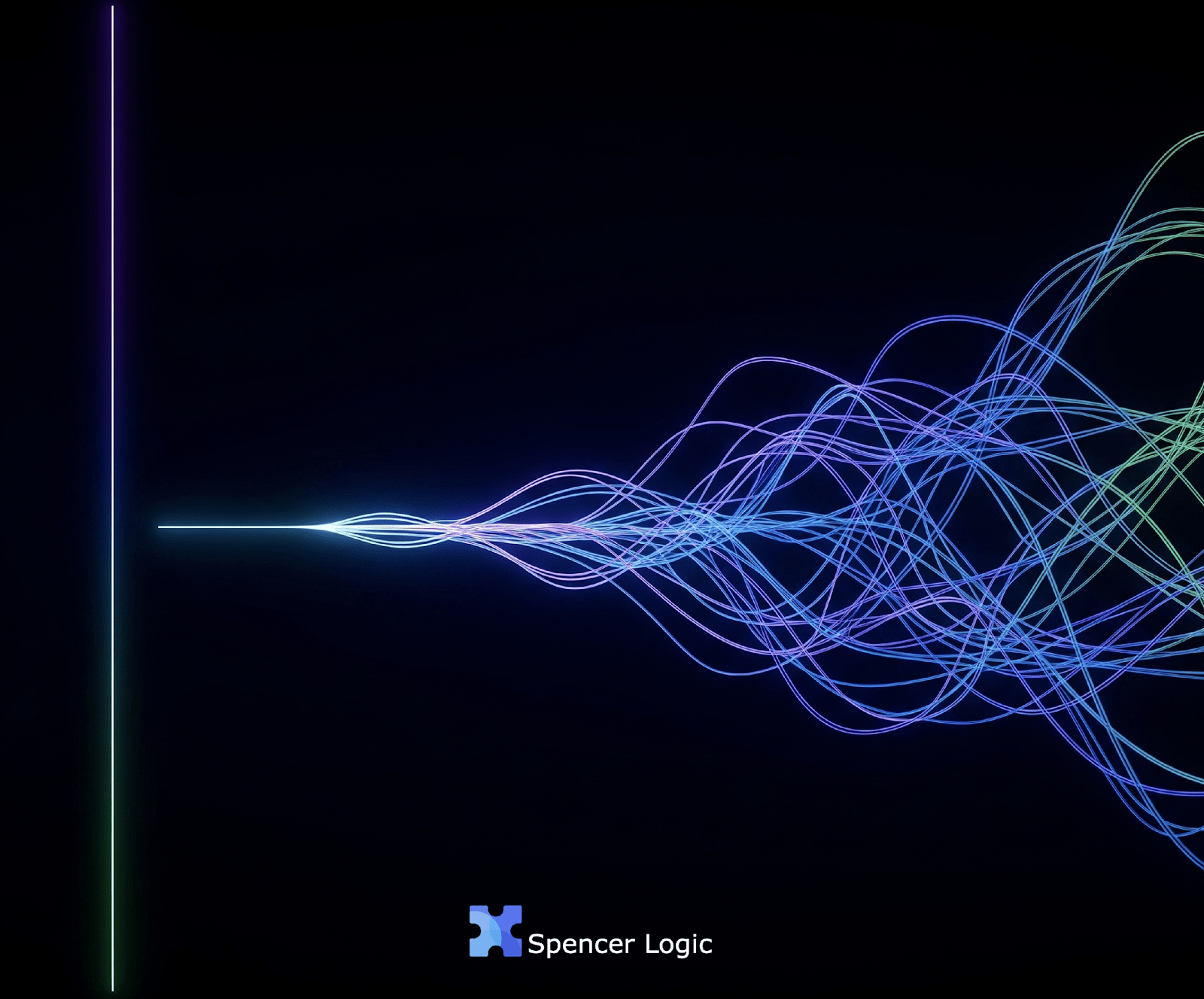

The Future of Liquidity Bridging: AI, Crypto Derivatives, and Tokenized Assets

Liquidity bridges are evolving from static routers into AI-driven execution engines.

Future systems will unify FX/CFD liquidity with crypto derivatives, DeFi AMMs, and tokenized-asset venues.

Tokenized collateral will enable cross-asset margining and greater capital efficiency.

December 2, 2025

Case Study: How a Mid-Sized Broker Scaled With Spencer Logic Bridging

A mid-sized broker overcame slippage, rejections, and client churn by upgrading to Spencer Logic’s modern bridging stack.

Latency dropped 35%, slippage improved 42%, and rejected orders fell 80% within the first month.

Trading volume grew 28% and client churn fell 15% — all without adding operational staff.

Modular architecture enabled rapid asset expansion into crypto and commodities.

November 25, 2025

Risk Management and A/B Book Execution in Liquidity Bridging

A-book, B-book, and hybrid models depend on smart routing — and bridging makes that automation possible.

Dynamic risk allocation allows brokers to define trade-by-trade hedging rules, reducing manual intervention.

Real-time exposure dashboards enhance capital efficiency and hedging precision.

Bridges provide audit trails essential for regulatory compliance and dispute protection.

Spencer Logic’s bridging engine unifies execution, risk, and transparency into a single intelligent framework.

November 20, 2025

The Economics of Bridging: Cost, ROI, and Broker Profitability

A modern bridging system is a revenue amplifier, not just a technical cost.

Reduced slippage, faster execution, and fewer rejections directly improve broker profitability.

Operational automation lowers staffing needs, errors, and support overhead.

Better execution quality boosts trader retention and lifetime trading volume.

Spencer Logic’s bridge delivers measurable ROI with improved fill rates, latency cuts, and seamless integrations.

November 18, 2025

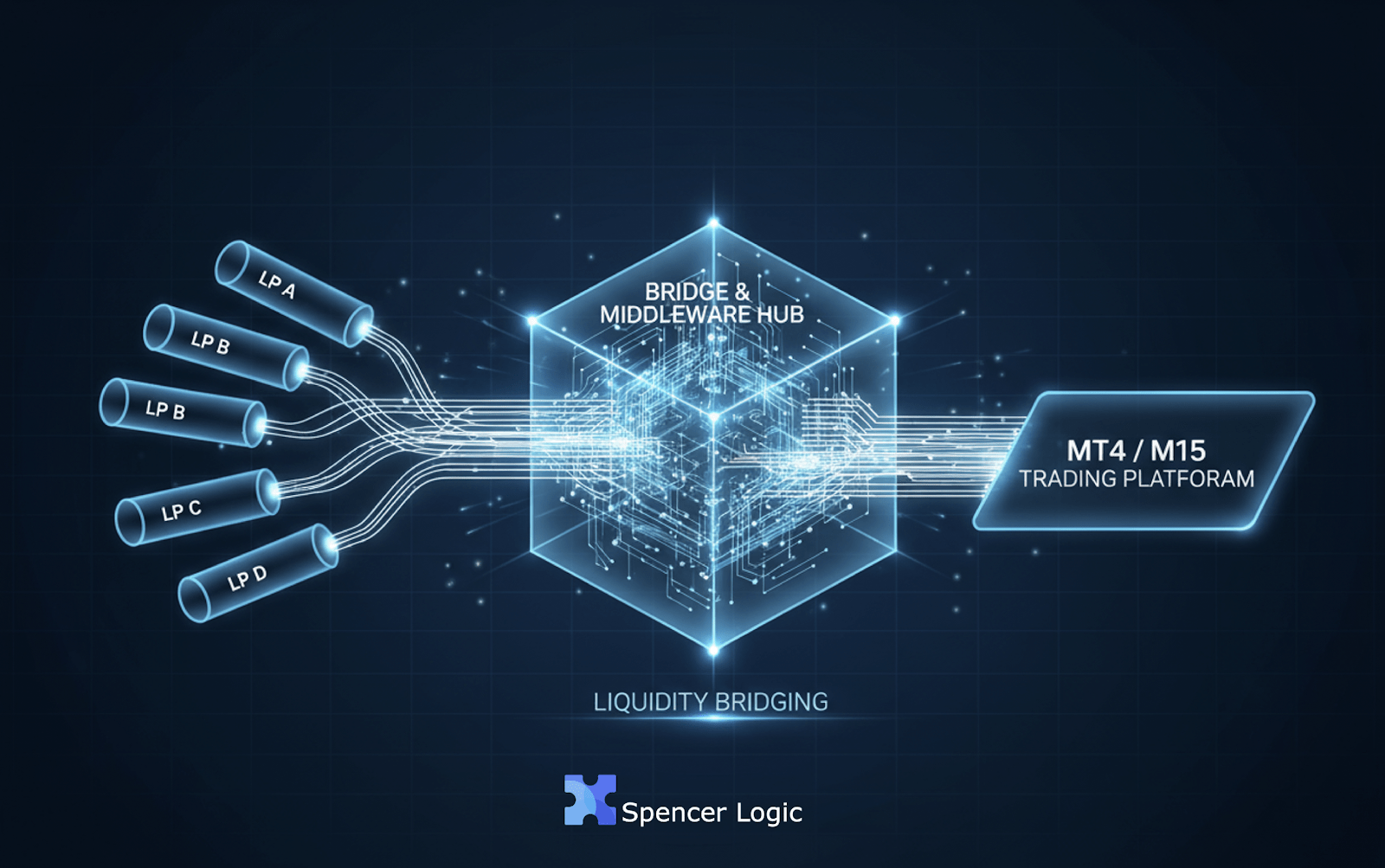

Integrating a Liquidity Bridge With MT4 and MT5: A Broker’s Technical Roadmap

Seamless MT4 & MT5 bridge integration = faster execution & higher trust.

Spencer Logic’s bridge reduces latency & improves accuracy.

Unified system for liquidity, risk, and compliance.

Multi-asset scalability with 24/7 operational support.

Future-ready: connects to traditional & digital markets.

November 6, 2025

Prime-of-Prime Liquidity Bridging: A Practical Playbook for Emerging Brokers

Emerging and mid-tier brokers access institutional markets through Prime-of-Prime (PoP) providers, and the key technology enabling this connection is the Liquidity Bridge.

November 4, 2025

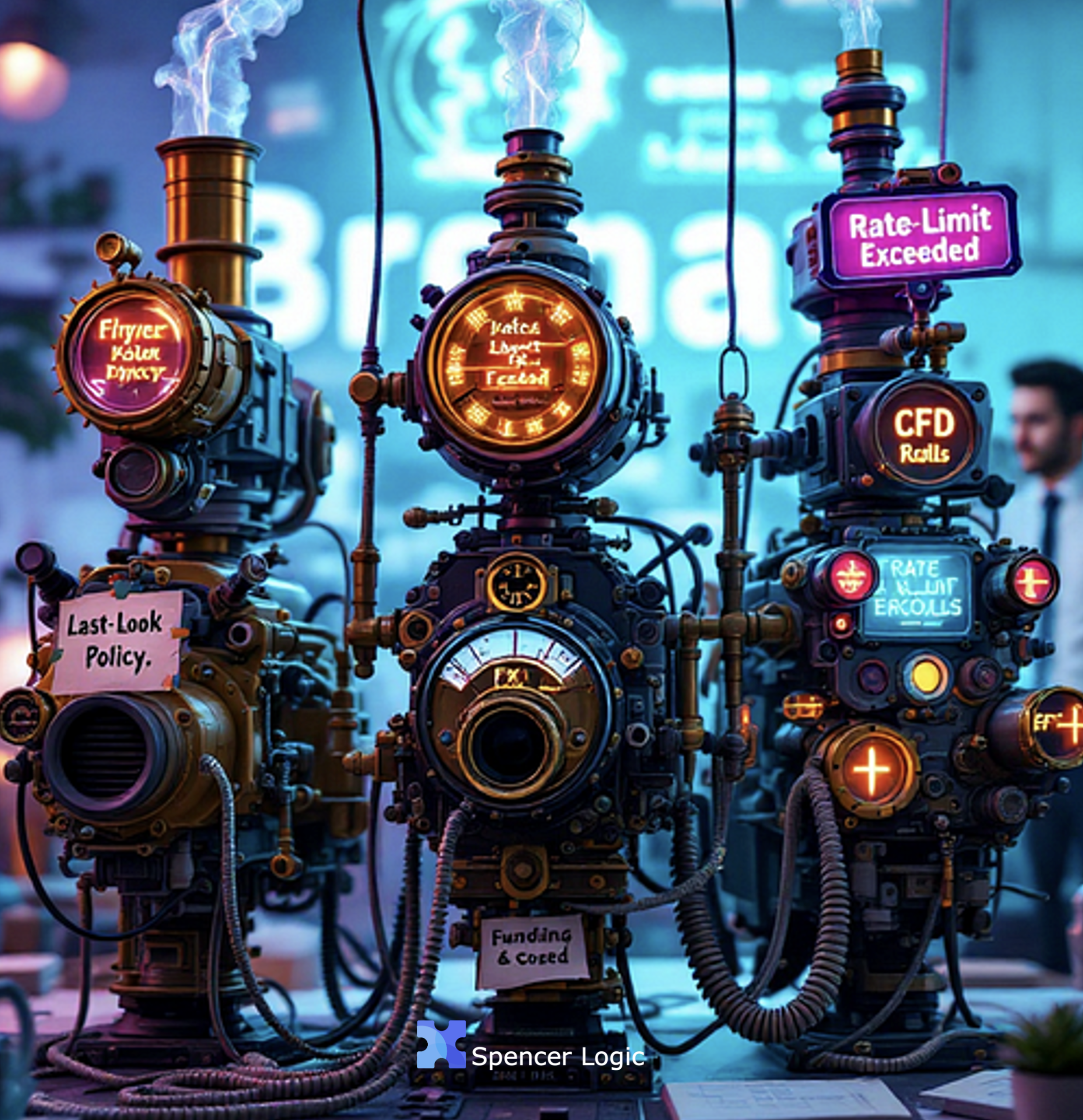

Reducing Slippage and Latency With a Modern Bridge Architecture

Speed = Trust: In modern trading, milliseconds decide client loyalty — low latency and minimal slippage are core to broker credibility and profitability.

Modern Architecture: Multi-threaded, co-located, and intelligently routed bridges eliminate bottlenecks, delivering near-zero execution delay.

October 28, 2025

Smart Order Routing in Bridging: How It Maximizes Fill Rates

The Challenge: Financial markets are fragmented; relying on a single liquidity source guarantees suboptimal pricing and poor fills (slippage/rejections) for traders.

The Solution: Smart Order Routing (SOR), integrated within a modern Liquidity Bridge, instantly compares all connected liquidity feeds (price, depth, latency) to find the absolute best execution path.

October 21, 2025

Liquidity Bridge vs. Aggregator: Key Differences and Use Cases

In the world of electronic trading, few terms are as frequently misunderstood as liquidity bridge and liquidity aggregator. Both are critical components in a broker’s technology stack, yet they serve different purposes. Many brokers use them interchangeably, which can lead to poor infrastructure decisions, higher costs, or suboptimal execution.

October 15, 2025

What is Liquidity Bridging? A Broker’s Guide to Faster Execution and Tighter Spreads

By Logic Pulse | Spencer Logic Insights Series TL;DR In today’s trading environment, clients expect brokers to provide more than just access to the markets....

October 9, 2025

Beyond the Blueprint: Mastering Liquidity Aggregation Through Continuous Performance & Explainability

Building a liquidity aggregation system is only half the battle. True mastery comes from its ongoing performance and, more importantly, its explainability. To turn your routing from a shrug into a strategy, you must:

September 29, 2025

How Liquidity Aggregation Really Works (And Why COOs Should Care)

TL;DR for busy COOs By Logic Pulse | Spencer Logic Insights Series Late on a Sunday open, Client A’s desk saw spreads breathe and pings...

September 15, 2025

The Chaos and the Cure: How Top Brokers are Unifying Their Multi-Asset Desks

By Logic Pulse | The Science of Brokerage Operations TL;DR for Busy COOs In the early days of advertising, my mentors taught me a simple,...

September 11, 2025

X Aggregation: The Journey from Simple to Scalable

By Logic Pulse | Spencer Logic Insights Series Choosing the right liquidity model is one of the most critical decisions an FX broker can make....

September 4, 2025

A Broker’s Guide to Liquidity Aggregation: Moving Beyond Technical Specsv

By Logic Pulse | Spencer Logic Insights Series Every FX broker faces a similar challenge: how to provide the best possible trading experience for clients...

September 2, 2025

The Lawsuit That Moves a Market: What Last Friday’s 9% XRP Jump Means for Your Business

By Logic Pulse | Spencer Logic Insights Series For the Time-Crunched Broker: A Quick-Fire Summary Last week, the digital asset world is buzzing. XRP is...

August 25, 2025

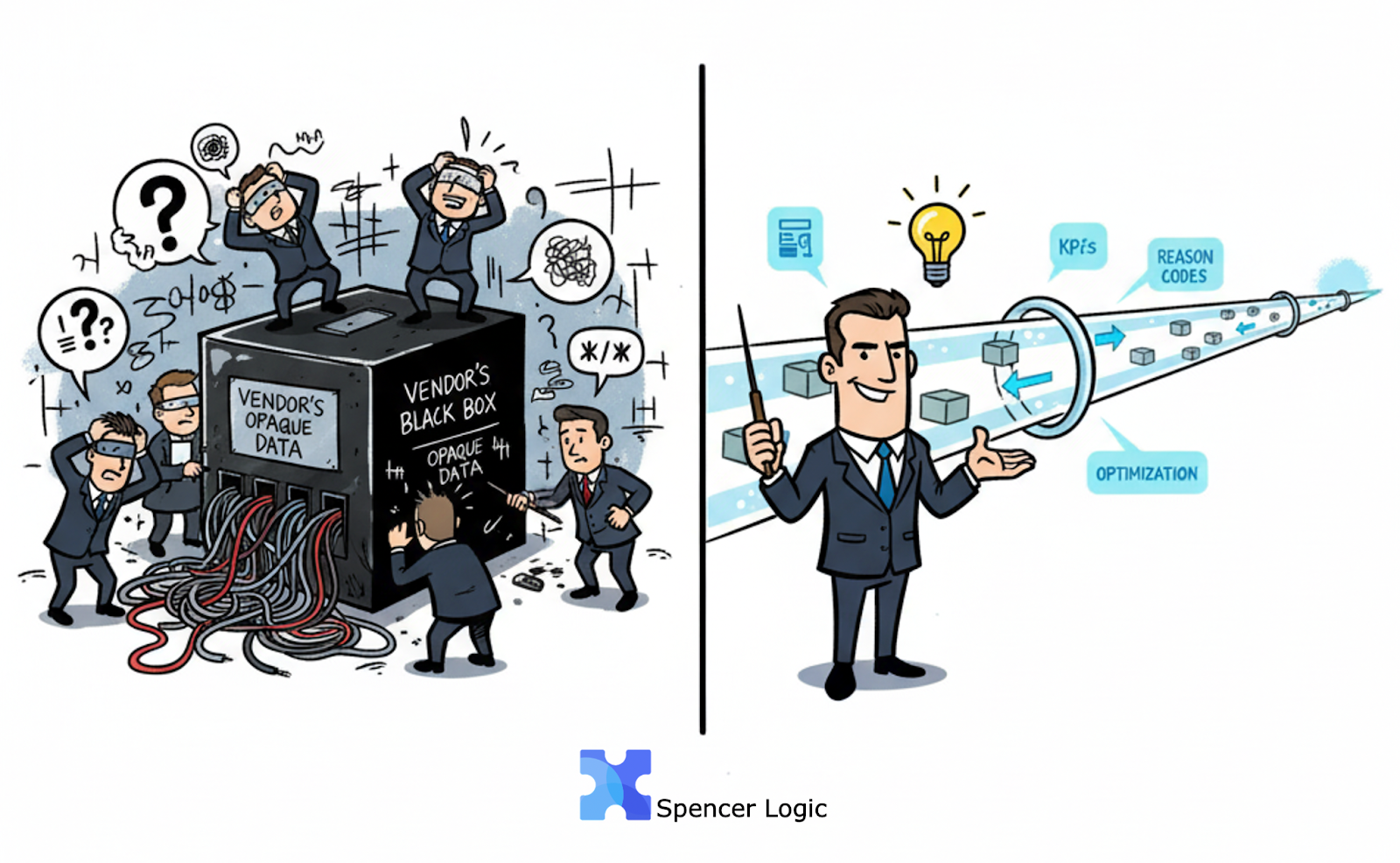

The AI Black Box: Why Your Brokerage’s Biggest Advantage Could Become Its Gravest Liability

By Logic Pulse | Spencer Logic For the Time-Crunched Broker: A Quick-Fire Summary A new wave of regulatory scrutiny is sweeping across the financial landscape,...

August 14, 2025

The Most Powerful Weapon for Brokers in an Age of Volatility: The Unavoidable Value of Liquidity Aggregation

By Logic Pulse | Spencer Logic Insights Series Recent headlines have screamed of geopolitical tensions and unprecedented market uncertainty. A new wave of unpredictability is...

August 7, 2025

Rise of the Retail Algo-Trader: Reinventing Broker Infrastructure for 2025

By Logic Pulse | Spencer Logic Insights Series Introduction In the past, algorithmic trading was a fortress — gated by PhDs, $10,000/month data feeds, and...

August 1, 2025

Crypto Surge 2.0: The Genius Act Is Lighting a Fire—Are You Ready to Scale or Fail?

New U.S. legislation is reigniting the crypto boom — but are brokers and exchanges ready on the backend?

July 24, 2025