By Logic Pulse | Spencer Logic Insights Series

Choosing the right liquidity model is one of the most critical decisions an FX broker can make. For many, a single liquidity provider (LP) seems like the straightforward choice: simple to launch, and often cost-effective. But what happens when simplicity becomes a constraint? The real journey for a scaling broker isn’t about finding a single solution, but about building a resilient, adaptable ecosystem that can grow with their business.

Let’s explore the true value of moving from a simple, single-LP setup to a multi-venue aggregation model—not through a technical spec sheet, but through the lens of a broker’s evolution.

TL;DR

- Effective Pricing: Aggregation introduces price competition across multiple venues , leading to tighter effective spreads.

- Boost Fill Rates: Unlike a single LP where you’re tied to one set of rules, an aggregator allows you to de-weight or exclude venues with poor fill behavior.

- Enhance Resilience: A single-LP setup has a single point of failure , while a multi-path aggregator provides failover protection during venue timeouts or stale quotes.

- Strengthen Your Story: Aggregation helps you build a stronger compliance narrative , and provides the granular data needed to justify your execution quality to IBs and regulators.

The Challenge: When “Simple” Isn’t Enough

A new broker often starts with a single LP, a lean and cost-effective approach. This works well initially. But as their client base grows and includes more sophisticated traders—the VIPs and Introducing Brokers (IBs)—new challenges emerge. The broker starts to receive feedback about widening spreads during volatile moments and a higher-than-desired number of rejections on larger trades.

The problem? A single stream, no matter how good, has its limits. The outcomes are tied to one set of rules, including last-look policies and throttles, which drive a big share of rejects. The broker finds their “simple” solution is now a single point of failure.

The Shift: Embracing Competitive Advantages

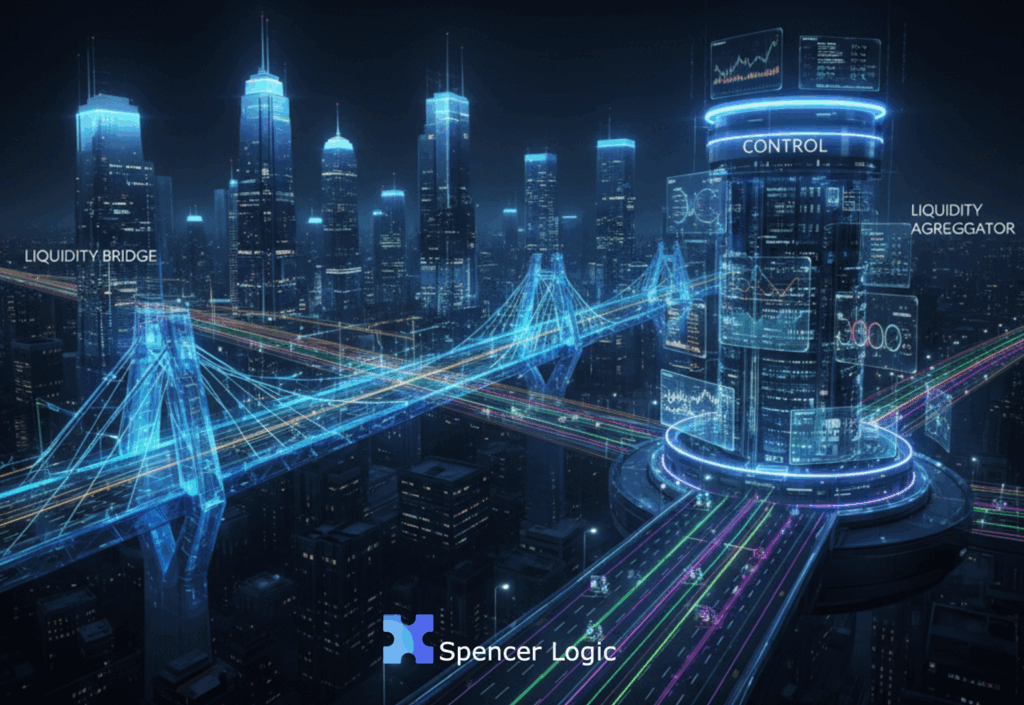

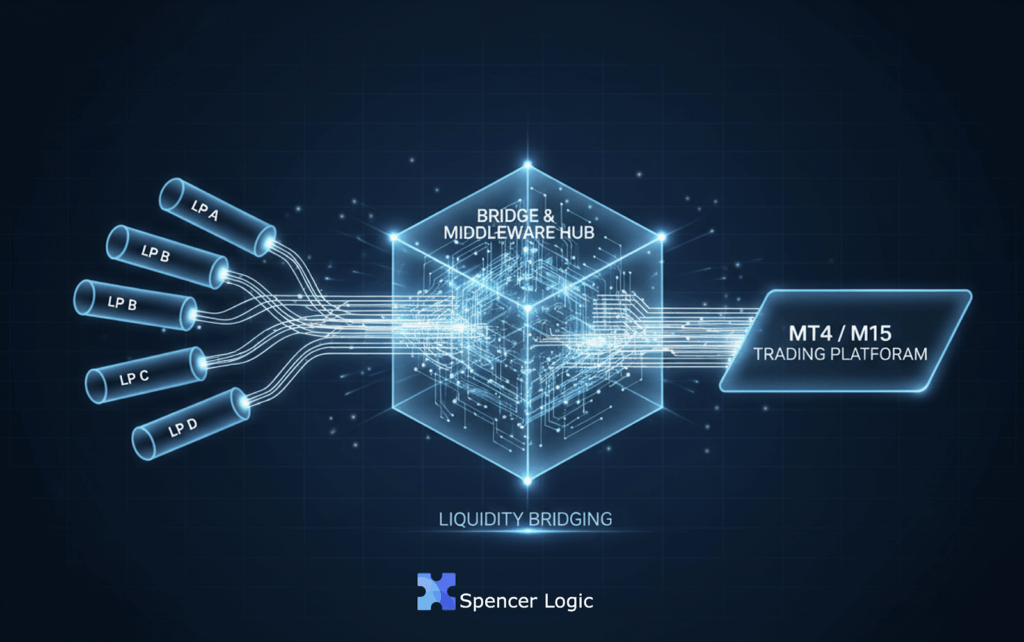

The broker decides to make a change. They choose to adopt an aggregation model, not just to add a new tool, but to fundamentally transform their offering. An aggregator consolidates streams from many venues, which are then scored by a Smart Order Router (SOR).

- Pricing & Depth: Instead of relying on a single price feed, they now have multiple competitive quotes that compress the top-of-book. By combining streams from various venues, they also gain significant depth at size, which improves the quality of large-ticket outcomes and helps to reduce price impact.

- Fills & Rejections: This is where the true power of aggregation shines. With a Smart Order Router (SOR), the broker can de-weight or exclude venues with poor fill behavior. They can route away from quotes that are deteriorating, or venues with strict last-look policies. The result? Fewer rejections and higher fill rates, which directly translates to happier, stickier clients and IBs.

Beyond the Numbers: Reliability and Trust

The transition to aggregation isn’t just about optimizing metrics; it’s about building a more resilient and trustworthy business. With a single LP, the path is stable but vulnerable. An aggregator provides a multi-path system with failover logic that automatically handles timeouts or stale quotes from a venue. This means fewer outages and a more reliable trading environment for clients.

For IBs, this move provides a powerful story. They want a visible improvement in fills and slippage for their VIPs. An aggregated model gives you a stronger narrative to share with them, complete with audit trails and the ability to explain why a specific order routed to a certain venue. The broker can even provide a monthly scorecard to IBs, showing transparently their Fill%, Reject%, and Slippage. This is a stronger narrative for both clients and regulators, aligning with principles of the FX Global Code.

The initial costs of infrastructure and monitoring are higher with an aggregator , but for a scaling broker with VIPs and IBs, the better fills at size, resilience, and compliance story often justifies it. This move is about graduating from a simple setup to a model that can support long-term growth.

This is just the second chapter in a series of articles on liquidity aggregation. We invite you to stay tuned for more stories on how to build a stronger and more resilient business.