By Logic Pulse | Spencer Logic Insights Series

For the Time-Crunched Broker: A Quick-Fire Summary

- The Big News: XRP is up 9% last Friday, a move largely driven by recent optimism surrounding the Ripple-SEC lawsuit and the prospect of a final resolution.

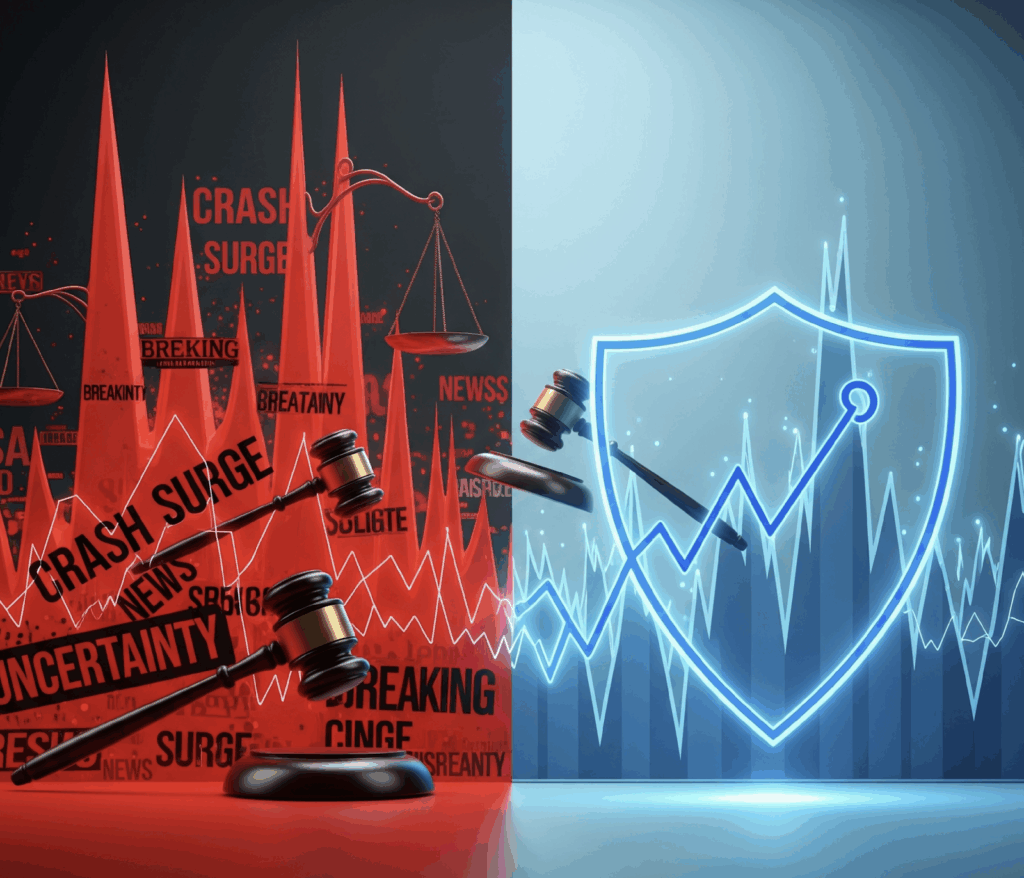

- The Big Problem: This news-driven volatility creates sudden surges in volume and liquidity demands, exposing brokers to increased risk, potential slippage, and operational stress.

- The Critical Takeaway: Relying on outdated or single-source technology during these events is a direct threat to your profitability and brand reputation. The market rewards those who are prepared for the unpredictable.

- The Spencer Logic Solution: Our Liquidity Aggregation and Risk Management System are purpose-built to handle these exact scenarios, providing the deep liquidity and proactive protection you need to turn chaos into a competitive advantage.

Last week, the digital asset world is buzzing. XRP is up 9%, a significant jump that has reignited conversations across social media and trading desks alike. But this isn’t just another price swing. This movement is a direct consequence of the most powerful catalyst in the crypto market: legal news. Recent developments in the protracted Ripple-SEC lawsuit have sparked a wave of optimism, leading traders to bid up the asset in anticipation of a favorable outcome. This isn’t just a trend; it’s a predictable pattern. News-driven volatility is becoming a major force in the crypto market, and the way your firm responds to it will define its success.

This new reality presents a formidable challenge for brokers and exchanges. A 9% price increase is not a gradual climb; it’s a sudden surge in demand for a single asset. Your platform is immediately tested. Can your infrastructure handle a sudden influx of orders without slowing down? Can you access the liquidity needed to fill those orders without significant slippage, protecting your clients and your firm? Can you manage the unexpected exposure this creates? In this environment, every millisecond counts, and every slippage point is a direct hit to your client’s trust and your bottom line.

A single-source liquidity provider can fail to meet the surge, leaving you exposed and unable to offer competitive spreads. An outdated risk management system might flag the high volume too late, allowing for significant and unnecessary exposure. Your clients are not just watching the price; they are watching your platform. They are judging your ability to perform under pressure. And if your platform fails to meet the moment, they will not hesitate to move their capital to a competitor who can.

This isn’t about luck. It’s about preparation. The winners in today’s market aren’t the ones with the cheapest fees; they are the ones with the most reliable, robust, and resilient infrastructure. They are the ones who can turn a chaotic event into a controlled opportunity.

A Proven Solution for an Unpredictable Market: Spencer Logic’s Technology

In a market where a single legal announcement can trigger a firestorm of trading activity, you need a technology partner who understands the stakes. Spencer Logic has spent years building a suite of tools that are purpose-built to thrive in this exact environment. Our solution isn’t just about providing technology; it’s about providing the confidence to compete.

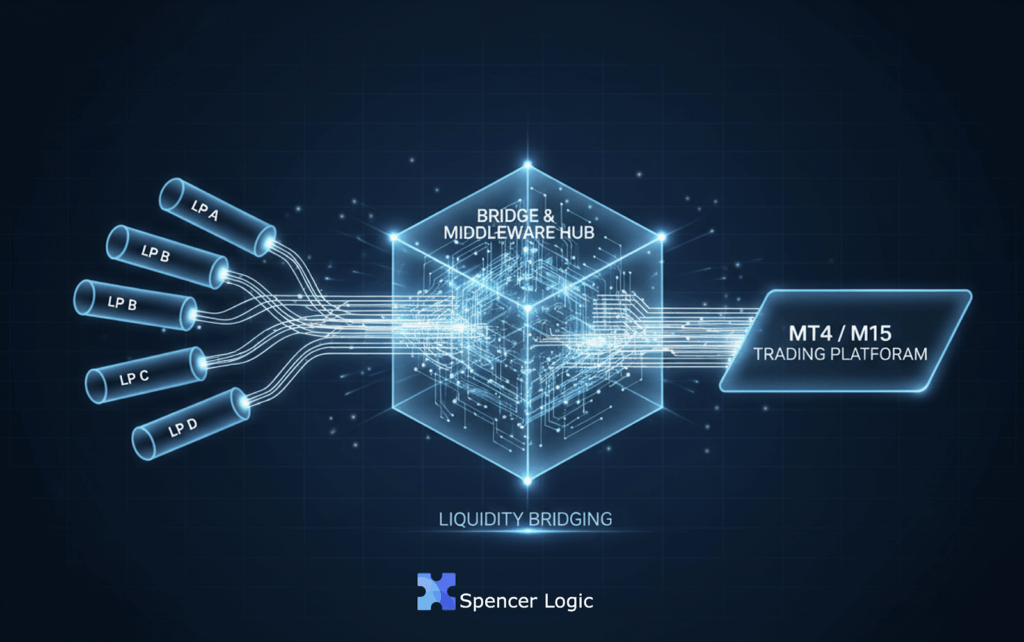

Our Liquidity Aggregation is the foundation of your success. We don’t connect you to just one or two liquidity providers; we seamlessly integrate with multiple top-tier sources, creating the deepest liquidity pool in the industry. When a sudden XRP surge hits, our system automatically routes trades to the best available prices, ensuring your clients get the fastest fills with minimal slippage. This isn’t just about efficiency; it’s about building a reputation for reliability.

The power of this system is amplified by our industry-leading Risk Management System. It provides you with a crystal-clear, real-time view of your firm’s exposure. You can set granular rules and automatically adjust to market conditions, ensuring that a sudden surge in a single asset doesn’t expose your firm to unnecessary risk. While your competitors are scrambling to manually rebalance, our system is proactively protecting your capital.

The market has spoken. Volatility driven by specific events is here to stay. Your choice is clear: you can be a victim of this volatility, or you can be a master of it. By leveraging Spencer Logic’s technology, you can ensure that the next time a headline moves a market, your firm is not just prepared—it’s poised to win.