By Logic Pulse | Spencer Logic Insights Series

TL;DR for Busy COOs

Building a liquidity aggregation system is only half the battle. True mastery comes from its ongoing performance and, more importantly, its explainability. To turn your routing from a shrug into a strategy, you must:

- Embrace the OPERA Framework: Observability, Performance Metrics, Explainability, Root Cause Analysis, and Adaptation are your keys to excellence.

- Own your data. Rely on your own Business Intelligence (BI) to prove outcomes, not on a vendor’s opaque reports.

- Demand explainability. Every order needs a paper trail. Implement reason codes to understand the “why” behind every execution, rejection, or timeout.

- Adapt intelligently. Use a phased approach, starting small with “shadow mode” and gradually increasing traffic only when your KPIs clear established thresholds.

The Unfinished Symphony of Liquidity

You’ve orchestrated the construction of a powerful liquidity aggregation system. The blueprint is complete, the instruments are in place, but the performance—the true symphony—has just begun. Many businesses stop here, treating their system as a static piece of technology. But a truly excellent system isn’t just built; it’s conducted—a masterpiece that demands constant tuning, observation, and masterful adaptation.

The reality is, a liquidity aggregation system is a living, breathing entity. It must adapt to volatile markets, shifting venue behaviors, and the relentless demand for a smooth, predictable client experience. The question is no longer merely “is it working?” but rather, “how magnificently is it performing, and can I robustly defend its every note?”

This is where your system goes beyond the blueprint, transforming into an unwavering source of competitive advantage.

OPERA Framework: The Blueprint for Operational Excellence

To ascend to mastery in your liquidity operation, you must embrace a continuous cycle of observation, analysis, and refinement. At Spencer Logic, we distill this into the OPERA Framework: Observability, Performance Metrics, Explainability, Root Cause Analysis, and Adaptation. These five elements, when harmonized, elevate your liquidity aggregation system from a mere tool to a strategic, defensible asset.

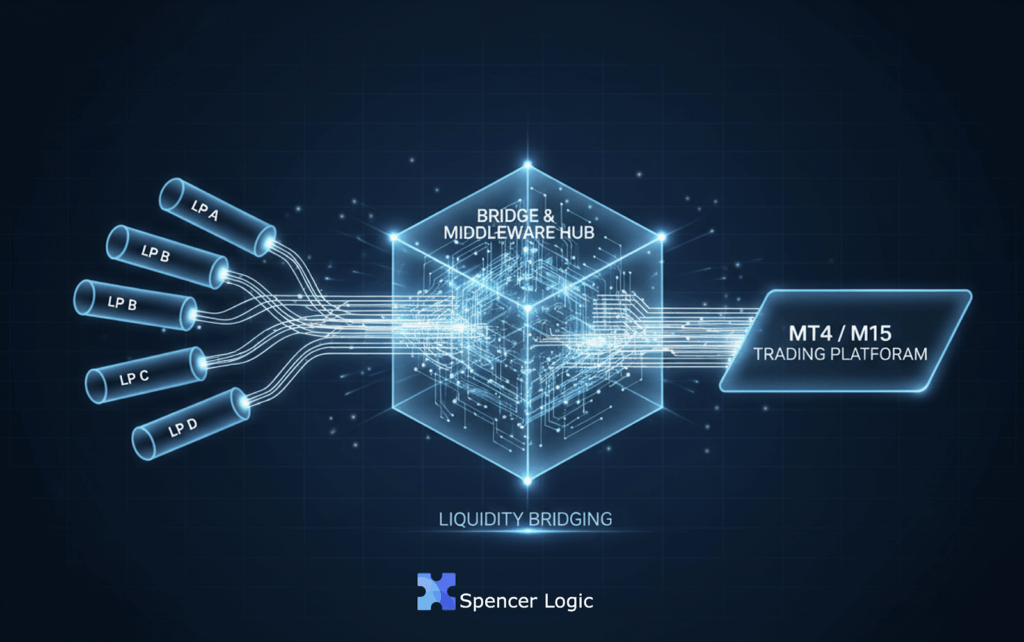

1. Observability: Knowing Your System’s Pulse

This is the foundation of any high-performing system. It’s about making the entire machine legible. Through drop-copy and logs, you gain a complete, unvarnished view of every transaction. This raw data fuels your own Business Intelligence (BI) system—which, let me be clear, must be the ultimate authority for computing KPIs and proving outcomes. A vendor’s black box report isn’t enough; your own BI must illuminate the true story. Without this transparent visibility, you are, quite simply, operating blind.

2. Performance Metrics: The Business Barometer

With robust observability in place, you then leverage your BI system to track the KPIs that genuinely move the needle. These aren’t just report card grades; they are your system’s vital signs, your early warning system.

- Fill Rate and Rejection Rate: Fundamental metrics, best bucketing by venue, symbol, size, and session, each enriched with corresponding reason codes.

- Order-to-Ack (ms): A critical venue stability indicator. Spikes here often predict incidents before your clients even perceive a tremor.

- Slippage and Markout: These track adverse selection, quantifying the true quality of your executions.

- Stale-Quote Ratio: A direct, piercing light on data health regressions and venue responsiveness.

3. Explainability, Root Cause Analysis & Adaptation: The Power of ‘Why’ and the Path to Improvement

Measuring is good, but diagnosing is great. As we’ve discussed, if your routing isn’t explainable, it isn’t a strategy. This is where the true power of OPERA’s remaining elements – Explainability, Root Cause Analysis, and Adaptation – shines.

E. Explainability: The Heart of OPERA

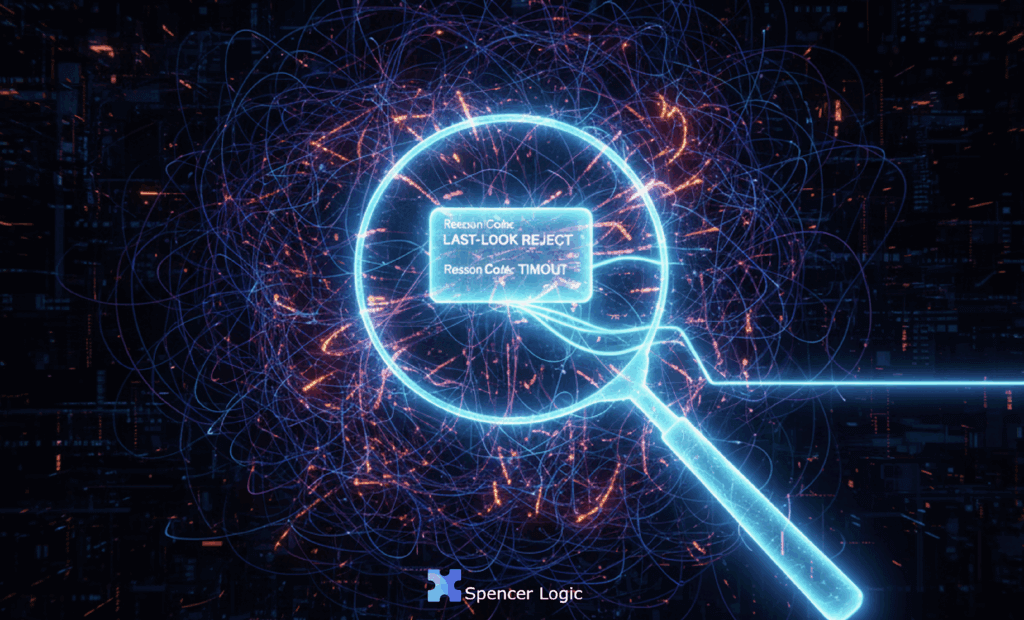

Every single order should carry a full record, including reason codes (e.g., stale quote, timeout, last-look reject), the weights in effect, and latency checkpoints from ingest to route to acknowledgment. This isn’t optional; it’s the irrefutable post-trade narrative that your desk can defend.

Imagine this scenario: you notice a sudden dip in fill rates. Instead of guessing, you query your reason codes. You find an unusual spike in last-look reject codes from a specific venue during the London/New York overlap. The data, precise and undeniable, tells you exactly where the system is “coughing”. This is how you transform a vague problem into a sharp, strategic adjustment.

This level of transparency and data-driven insight has already transformed our clients’ operations:

Case Study: a Top-Tier Broker/Exchange

“We started with a small symbol pack in shadow mode, feeding it through the new stack. Within days, our reason codes cleaned up, last-look rejects fell during overlaps, and order-to-ack dropped. The monthly scorecard now tells the story—no hand-waving.”

— Client A, COO at a broker located in UAE

R. Root Cause Analysis: Unraveling the ‘Why’

The beauty of Explainability is that it directly fuels Root Cause Analysis. The “why” uncovered by your reason codes isn’t just information; it’s the starting gun for diagnosis. When timeout codes surge, you can swiftly pinpoint a specific venue’s connectivity issues. When last-look reject codes rise, you can investigate specific liquidity provider behaviors. This eliminates guesswork, allowing your team to move from symptom to solution with surgical precision.

A. Adaptation: Evolving with Intelligence

Diagnosis, however, is merely a step. The final act in your operational symphony is Adaptation. This is the continuous cycle of using your measured performance and diagnosed insights to refine and improve your system.

- Tune with Data, Not Bravado: Start with conservative spread floors and only tighten them with realized data, never a hunch.

- Ramp by Gates: When introducing new logic or venues, promote traffic gradually (10% → 25% → 50% → 100%) only when your KPIs meet established thresholds, often leveraging shadow mode for safe testing.

- Listen to the Alarms: Alert on stale-quote ratio and order-to-ack spikes; they are your earliest indicators of a venue incident requiring adaptation.

Conclusion: Build Trust, Not Just Technology

When you build for Explainability and tune with your own BI, your desk doesn’t just manage liquidity; it conducts it with mastery. Your team operates with a calm confidence, even when the market roars. You aren’t just aggregating liquidity; you are creating a predictable, defensible, and continuously improving operation that builds an unshakeable trust.

Spencer Logic stands ready to be your partner in this endeavor, helping you move beyond the blueprint to a continuously performing, fully explainable, and trusted liquidity operation.