By Logic Pulse | Spencer Logic Insights Series

TL;DR: Liquidity Bridge vs. Aggregator

- Bridge = Connectivity: The Liquidity Bridge is the essential gateway connecting the trading platform (MT4/MT5) to LPs, handling order routing and risk management (A/B/Hybrid).

- Aggregator = Optimization: The Liquidity Aggregator is the engine that combines multiple LP price feeds to create the tightest spreads and ensure best execution (essential for scale and competitiveness).

- Relationship: The Bridge is the foundational infrastructure, and the Aggregator is the optimizer; you need the Bridge to function, and the Aggregator to win on pricing.

- Spencer Logic Advantage: We offer an integrated Bridging & Aggregation Stack, providing both superior connectivity and optimal execution from a single, streamlined platform.

In the world of electronic trading, few terms are as frequently misunderstood as liquidity bridge and liquidity aggregator. Both are critical components in a broker’s technology stack, yet they serve different purposes. Many brokers use them interchangeably, which can lead to poor infrastructure decisions, higher costs, or suboptimal execution.

To scale successfully — whether you’re a startup broker or an established firm expanding into multi-asset markets — it’s essential to understand how these two systems differ, how they interact, and when each becomes necessary.

This article clarifies the relationship between liquidity bridges and aggregators, explores their key differences, and explains how brokers can leverage both strategically to improve execution, reduce costs, and enhance competitiveness.

The Role of Connectivity in Modern Brokerage

Electronic trading is built on connectivity. A broker’s success depends on how efficiently orders flow between traders, trading platforms, and liquidity providers (LPs). When traders click “Buy” or “Sell,” they expect an instant, fair, and transparent fill. Behind that simplicity lies a complex network of systems that route, match, and confirm each trade in milliseconds.

Two of the most critical systems in this process are the liquidity bridge and the liquidity aggregator. They are often developed as part of the same ecosystem, but their core functions differ. The bridge ensures communication between the trading platform and external liquidity venues, while the aggregator optimizes how prices are compiled and orders are executed across multiple liquidity sources.

Think of it this way: the bridge is the road that connects your brokerage to the market, and the aggregator is the traffic controller that manages which lane each order should take for the best result. Both are necessary, but they handle distinct parts of the execution journey.

What Is a Liquidity Bridge?

A liquidity bridge is middleware that connects your trading platform — such as MT4, MT5, or cTrader — to one or more external liquidity providers. It translates and routes trading instructions using standard financial communication protocols like FIX API.

The bridge’s job is to ensure that every trade initiated on your platform is transmitted, filled, and confirmed as efficiently as possible. It handles order routing, manages risk exposure, and supports A-book, B-book, or hybrid execution models.

A well-designed bridge acts as a broker’s control center, offering visibility into execution quality, latency, and slippage. It also provides tools to monitor order flow, set markups, and define routing logic based on volume, instrument, or client group.

In short, the bridge is the broker’s gateway to liquidity — the infrastructure that makes external execution possible.

What Is a Liquidity Aggregator?

While the bridge connects systems, the aggregator enhances execution efficiency by combining price feeds from multiple liquidity providers into a single, optimized stream. Instead of relying on one LP’s quotes, an aggregator compares all incoming bids and asks, identifies the best combination, and constructs a synthetic order book that delivers the tightest possible spreads.

This process, known as price aggregation, directly impacts how competitive your pricing appears to traders. For example, one LP might offer the best bid, while another offers the best ask. The aggregator merges these into a composite quote that your platform displays to clients.

Beyond price construction, aggregators can split large orders across several LPs to minimize market impact — a process known as order slicing or sweeping. They can also apply smart order routing (SOR) logic to ensure each order is executed at the best available price with minimal slippage.

In other words, the aggregator optimizes liquidity, ensuring that the connection provided by the bridge is not only functional but also efficient.

Bridge vs. Aggregator: The Core Differences

While both systems are part of the same execution flow, their functions are distinct. The easiest way to understand the difference is to compare their roles side by side:

| Feature | Liquidity Bridge | Liquidity Aggregator |

| Primary Role | Connects trading platforms to liquidity providers | Combines and optimizes prices from multiple LPs |

| Focus | Connectivity, routing, and risk management | Price construction and execution optimization |

| Protocols | FIX API, proprietary APIs | FIX API, market data feeds |

| Execution Models | Supports A-book, B-book, hybrid setups | Focuses on best-execution logic for A-book orders |

| Users | Brokers managing connectivity | Brokers or institutional desks managing pricing and execution quality |

| Key Benefit | Enables external execution and control | Ensures best pricing and deeper liquidity access |

A bridge can exist without an aggregator — for example, if a broker connects to a single LP or prime-of-prime. However, an aggregator cannot function without a bridge or another form of connectivity to transmit its orders.

The bridge is the foundation. The aggregator is the optimizer. Together, they define a broker’s ability to compete on both speed and pricing.

How the Two Work Together in Practice

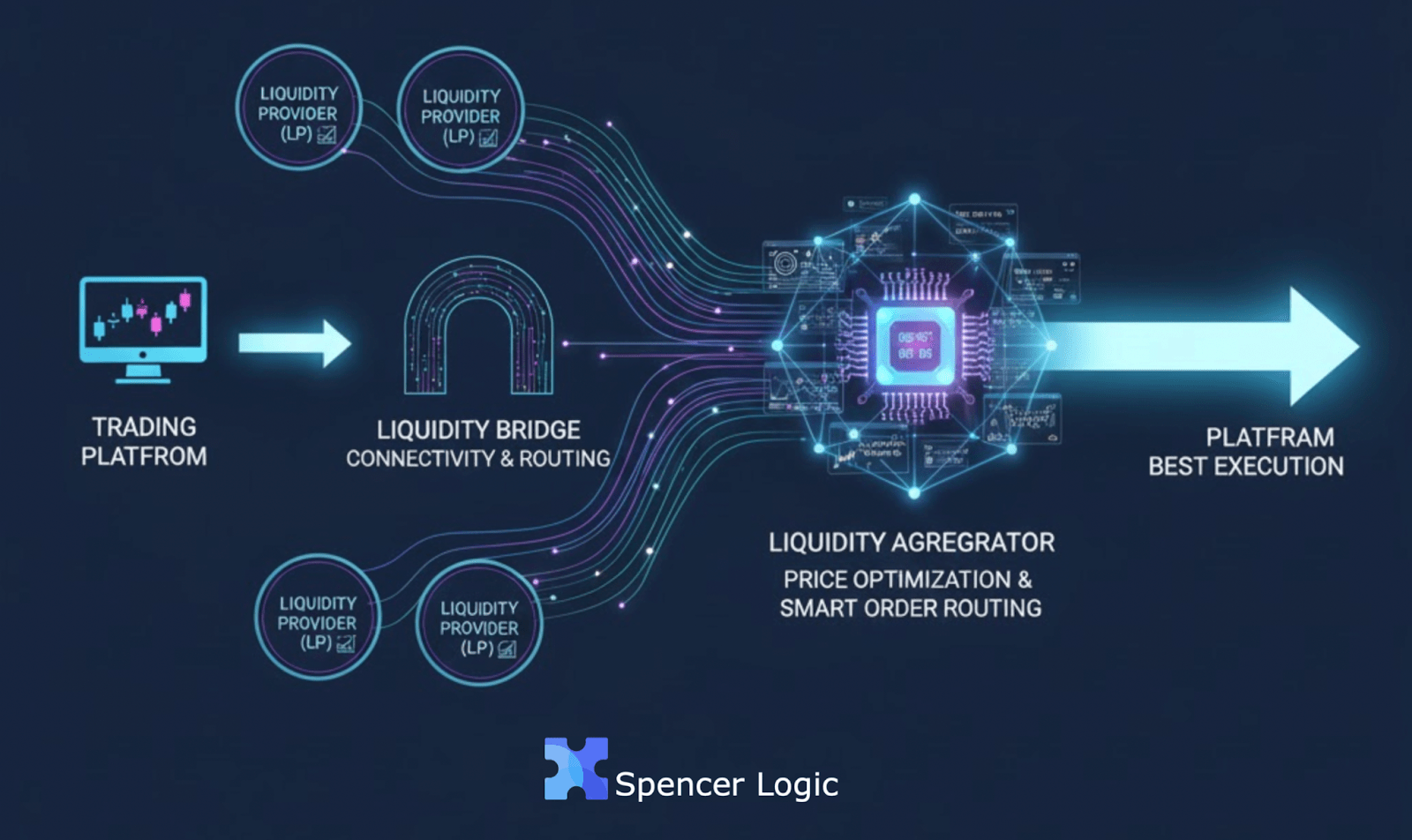

In a modern brokerage environment, bridging and aggregation typically operate as part of a single workflow:

- Trader places an order on MT4 or MT5.

- The bridge receives the order and routes it to the aggregator or directly to a designated LP.

- The aggregator compares prices from connected LPs, selects the best available combination, and executes the trade.

- The bridge confirms the fill, applies markups or commissions, and returns the confirmation to the trading platform.

This workflow happens in milliseconds, ensuring seamless execution from the trader’s perspective.

In Spencer Logic’s architecture, the bridge and aggregator components are tightly integrated. This allows brokers to enjoy both connectivity and optimization without juggling multiple vendors or complex integrations.

Why the Distinction Matters for Emerging Brokers

For new or scaling brokers, understanding the difference between a bridge and an aggregator is not just technical — it’s strategic. Early infrastructure decisions determine how scalable, profitable, and compliant your brokerage can become.

A broker that only installs a basic bridge may be able to execute trades but might offer uncompetitive spreads compared to rivals using aggregation. Conversely, investing in an aggregator without a stable bridge can lead to execution delays, data mismatches, or liquidity disconnects.

Getting the combination right from the start ensures that your brokerage can:

- Offer institutional-grade execution to retail clients.

- Compete on pricing without compressing your margins.

- Expand seamlessly across multiple liquidity providers and asset classes.

- Maintain transparency and control over every trade.

In a market where traders can switch brokers in seconds, infrastructure quality becomes a major differentiator.

The Evolution of Bridging and Aggregation Technology

Historically, liquidity bridges were simple connectors — software layers that relayed orders from MT4 to a liquidity provider. Aggregation, if it existed at all, was manual or limited to a few price feeds.

Today, both have evolved dramatically. Modern bridging systems integrate advanced risk engines, dynamic routing, and even real-time analytics. Aggregators now include algorithmic execution features, multi-asset support, and customizable order slicing strategies.

This evolution reflects the changing nature of trading. As clients demand access to FX, metals, indices, crypto, and derivatives under a single account, brokers must build systems capable of handling complex execution scenarios. Bridging and aggregation have become inseparable parts of that solution.

At Spencer Logic, this philosophy is embedded into our design: a multi-asset bridging stack that combines deep connectivity, smart order routing, and liquidity optimization in one unified platform.

When You Need a Bridge (But Not Yet an Aggregator)

If you are a small or newly launched broker connecting to a single LP or prime-of-prime, a liquidity bridge alone may be sufficient in the beginning. It will allow you to execute trades externally, manage markups, and monitor risk efficiently.

This setup is especially suitable when:

- You have limited trading volume.

- Your client base trades mainly major FX pairs.

- Your goal is to establish operational stability before scaling liquidity sources.

However, once trading volume increases and client expectations rise, the absence of aggregation will begin to show — typically in the form of wider spreads, occasional slippage, and inconsistent fills during high volatility. At that point, adding aggregation capabilities becomes the natural next step.

When an Aggregator Becomes Essential

As your brokerage grows, offering competitive spreads and stable execution across multiple liquidity providers becomes essential. This is where a liquidity aggregator transitions from a “nice to have” to a “must have.”

You’ll know it’s time to integrate aggregation when:

- You’re connected to three or more LPs.

- You’re competing on tight spreads or ECN-style execution.

- Your traders include algorithmic or high-frequency users.

- You notice inconsistent fills across different market conditions.

An aggregator ensures you’re making the most of your liquidity relationships. It not only improves the prices you display but also increases execution speed and fill ratio — all of which translate directly into trader satisfaction and retention.

Cost and Complexity Considerations

While the technical concepts are straightforward, the implementation can vary widely depending on architecture and vendor. Some brokers prefer modular setups — separate bridge and aggregator vendors — while others choose integrated solutions like Spencer Logic’s all-in-one stack.

Modular setups offer flexibility but can introduce complexity, requiring multiple support teams, version synchronization, and separate monitoring tools. Integrated solutions, on the other hand, streamline operations, provide unified reporting, and simplify maintenance.

From a cost perspective, integrated systems typically reduce total cost of ownership (TCO) because they eliminate redundant licenses and infrastructure overhead. For emerging brokers with limited IT resources, this simplicity often outweighs the perceived flexibility of separate systems.

The Business Impact: Beyond Technology

Choosing between a bridge, an aggregator, or both isn’t only about technology — it directly affects your business metrics.

- Spreads and Pricing: Aggregation tightens spreads, improving your market competitiveness.

- Execution Quality: A stable bridge ensures orders are filled consistently.

- Client Retention: Traders stay with brokers that execute efficiently.

- Liquidity Relationships: Reliable connectivity attracts better LP terms.

- Regulatory Readiness: Accurate routing and reporting simplify compliance.

Ultimately, the right configuration creates a virtuous cycle — better execution drives higher trading volume, which attracts more liquidity and allows even better pricing.

Case Example: From Single LP to Aggregated Infrastructure

Consider a mid-sized FX broker that initially connected to one prime-of-prime via a simple bridge. As the client base grew, so did complaints about inconsistent spreads and slippage during major news events.

The broker integrated an aggregation layer capable of sourcing quotes from five LPs and applying smart order routing. Within weeks:

- Average spreads narrowed by 18%.

- Fill ratio improved by 9%.

- Client retention increased noticeably among active traders.

The infrastructure upgrade paid for itself within a few months, not through additional marketing, but through better execution — proof that technology decisions can have direct commercial impact.

The Future: AI-Assisted Bridging and Aggregation

The next evolution in liquidity infrastructure lies in automation and intelligence. AI-driven bridging systems can analyze execution data in real time, detect latency anomalies, and adjust routing dynamically. Aggregators are beginning to use predictive algorithms to forecast quote stability, helping brokers minimize slippage before it happens.

Spencer Logic’s R&D roadmap already integrates elements of this future — adaptive routing, performance scoring of liquidity providers, and machine-learning–based optimization to enhance execution efficiency across markets.

In the coming years, brokers who embrace intelligent bridging and aggregation will be able to deliver a trading experience indistinguishable from institutional-grade platforms — even for retail clients.

Conclusion

Liquidity bridges and aggregators are not rivals; they are partners in delivering world-class execution. The bridge connects your platform to the global liquidity network, while the aggregator refines that connection into competitive, optimized pricing.

For emerging brokers, the path forward is clear: start with a solid bridging foundation, and evolve into aggregation as your liquidity relationships and trading volume grow. Together, these systems form the infrastructure that determines whether your brokerage can scale sustainably in an increasingly demanding market.At Spencer Logic, we provide an integrated Bridging & Aggregation Stack designed specifically for multi-asset brokers. Our technology delivers low-latency connectivity, real-time optimization, and flexible execution control — all from a single, unified platform. If you’re ready to enhance your execution and pricing architecture, explore our Bridging Solution and see how Spencer Logic helps brokers build faster, smarter, and more scalable infrastructures.