TL;DR

- Liquidity bridges are evolving from static routers into AI-driven execution engines.

- Future systems will unify FX/CFD liquidity with crypto derivatives, DeFi AMMs, and tokenized-asset venues.

- Tokenized collateral will enable cross-asset margining and greater capital efficiency.

- AI-powered compliance and transparency will become mandatory for regulatory trust.

- Spencer Logic is developing next-gen, multi-asset, intelligence-driven bridging technology.

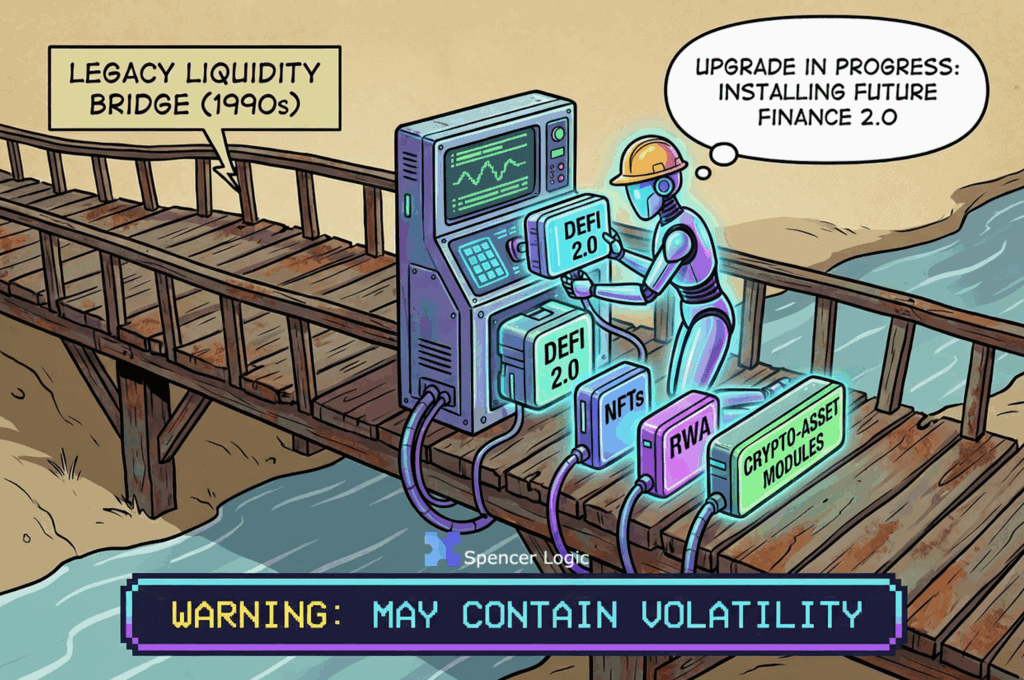

Financial markets are in the midst of a structural transformation. The boundaries between traditional finance and digital assets are dissolving, and with them, the technology that connects brokers to liquidity must evolve. The next generation of liquidity bridges will not simply route orders — they will think, learn, and adapt in real time.

This final article in our bridging series explores the future of bridging technology: the rise of AI-driven routing, the integration of crypto derivatives and tokenized assets, and the convergence of decentralized and centralized liquidity.

AI-Driven Execution Intelligence

Machine learning is already reshaping liquidity management. Future bridges will incorporate predictive analytics that evaluate liquidity provider performance continuously, adjusting routing decisions before issues arise.

Imagine a bridge that identifies patterns — such as LPs whose latency spikes during news events — and reroutes flow proactively. Over time, the bridge builds a performance model for every liquidity venue, creating a self-optimizing execution ecosystem.

Spencer Logic’s research team is pioneering this evolution. Our prototype systems leverage real-time data to score liquidity providers, enabling brokers to allocate order flow dynamically based on historical reliability, not static rules.

Bridging Into the Digital Asset Ecosystem

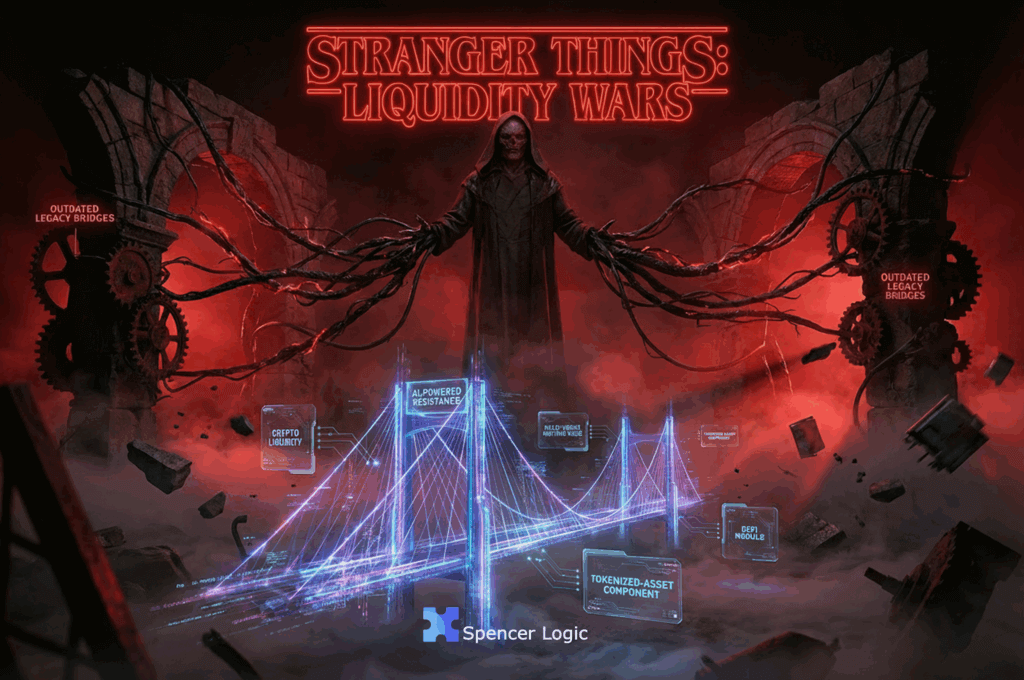

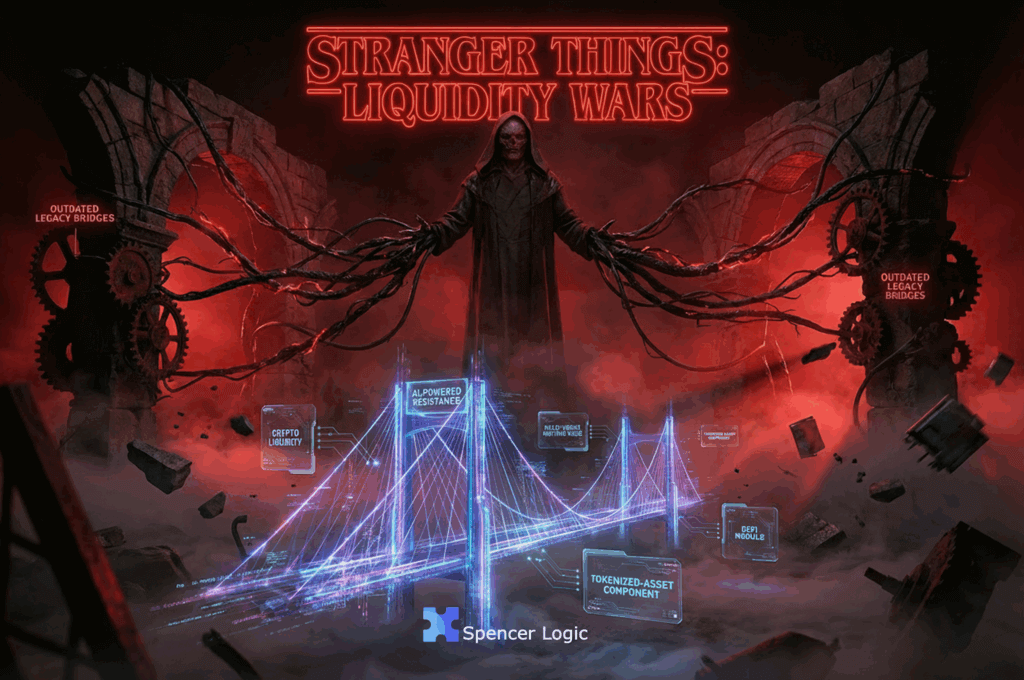

Crypto derivatives, perpetual swaps, and tokenized instruments are becoming mainstream trading products. Yet, most legacy bridges were designed exclusively for FX and CFDs, with rigid data structures unsuitable for on-chain or exchange-based liquidity.

The next generation of bridging will unify these worlds. A broker’s bridge will connect not only to Tier-1 liquidity providers but also to crypto exchanges, on-chain AMMs, and tokenized-asset venues. It will standardize APIs across centralized and decentralized liquidity, allowing traders to access both from the same interface.

This multi-venue architecture requires new risk models, especially for custody and settlement. Bridges will integrate wallet management, margin synchronization, and real-time collateral tracking to ensure secure, compliant operation across all asset types.

Tokenization and the Rise of Universal Collateral

Tokenized assets are redefining how capital moves. Whether tokenized U.S. Treasuries, equities, or commodities, each introduces new liquidity dimensions that brokers can access through enhanced bridging.

Future bridges will support tokenized collateral management — allowing brokers to post, receive, and track margin in digital assets. This will improve capital efficiency and enable cross-asset trading where crypto holdings can collateralize FX or CFD positions.

Spencer Logic envisions bridges as liquidity gateways rather than simple connectors: platforms that abstract away the complexity of blockchain settlement while maintaining institutional execution quality.

Regulation and Transparency

As asset classes converge, regulatory frameworks will evolve to demand even greater transparency. AI-enhanced bridges will automate compliance by generating real-time audit logs, trade attestations, and market surveillance reports.

The capacity to demonstrate best execution across centralized and decentralized venues will become a defining competitive advantage. Brokers using intelligent bridges will not only meet compliance standards but exceed them, offering institutional investors unprecedented trust in execution integrity.

The Human Element Remains

Despite automation, one principle remains unchanged: trust. The bridge will continue to serve as the technological manifestation of that trust between brokers, clients, and liquidity partners. Technology can replace friction, not relationships.

For brokers, success in the future market will depend on choosing partners who combine engineering expertise with market understanding — those capable of navigating both traditional and digital ecosystems with equal precision.

Conclusion

Liquidity bridging is entering a new era — one defined by intelligence, interoperability, and transparency. The brokers who embrace this evolution early will define the standards of tomorrow’s markets.Spencer Logic is committed to leading that transition. Our bridging technology is evolving into an AI-driven, multi-asset platform built to connect the liquidity of the future.

To learn how we can prepare your brokerage for the next generation of markets, visit Bridging Solution.