TL;DR

- Speed = Trust: In modern trading, milliseconds decide client loyalty — low latency and minimal slippage are core to broker credibility and profitability.

- Modern Architecture: Multi-threaded, co-located, and intelligently routed bridges eliminate bottlenecks, delivering near-zero execution delay.

- Continuous Optimization: Real-time analytics and adaptive routing automatically detect and fix latency sources, ensuring consistent fill quality.

- Spencer Logic Advantage: Sub-millisecond performance, 99.99% uptime, and self-learning optimization make it an institutional-grade bridging solution.

In electronic trading, milliseconds define competitiveness. A few years ago, traders tolerated modest delays or price deviations; today, they abandon brokers the moment execution feels inconsistent. As algorithmic and high-frequency trading continue to dominate, execution speed and stability have become the most measurable expressions of trust. The infrastructure that governs these micro-moments is the liquidity bridge — the unseen yet decisive layer between a broker’s trading platform and the world’s liquidity venues.

Modern bridge architecture has evolved from a simple connector to a performance engine capable of reducing latency, minimizing slippage, and maximizing fill quality. For brokers, understanding how bridge design affects these outcomes is no longer a purely technical issue; it is a business imperative that directly determines retention, spreads, and brand reputation.

The Cost of Delay

Latency refers to the time taken for an order to travel from a trader’s platform to a liquidity provider and back again. Even a few extra milliseconds can lead to execution at less favorable prices, particularly during volatile market events. When the market moves before an order is filled, the result is slippage — the difference between the expected price and the actual execution price.

For market makers and A-book brokers alike, slippage is expensive. It distorts P&L, increases hedging costs, and frustrates clients. In an environment where spreads are razor-thin, controlling latency becomes synonymous with protecting profit margins.

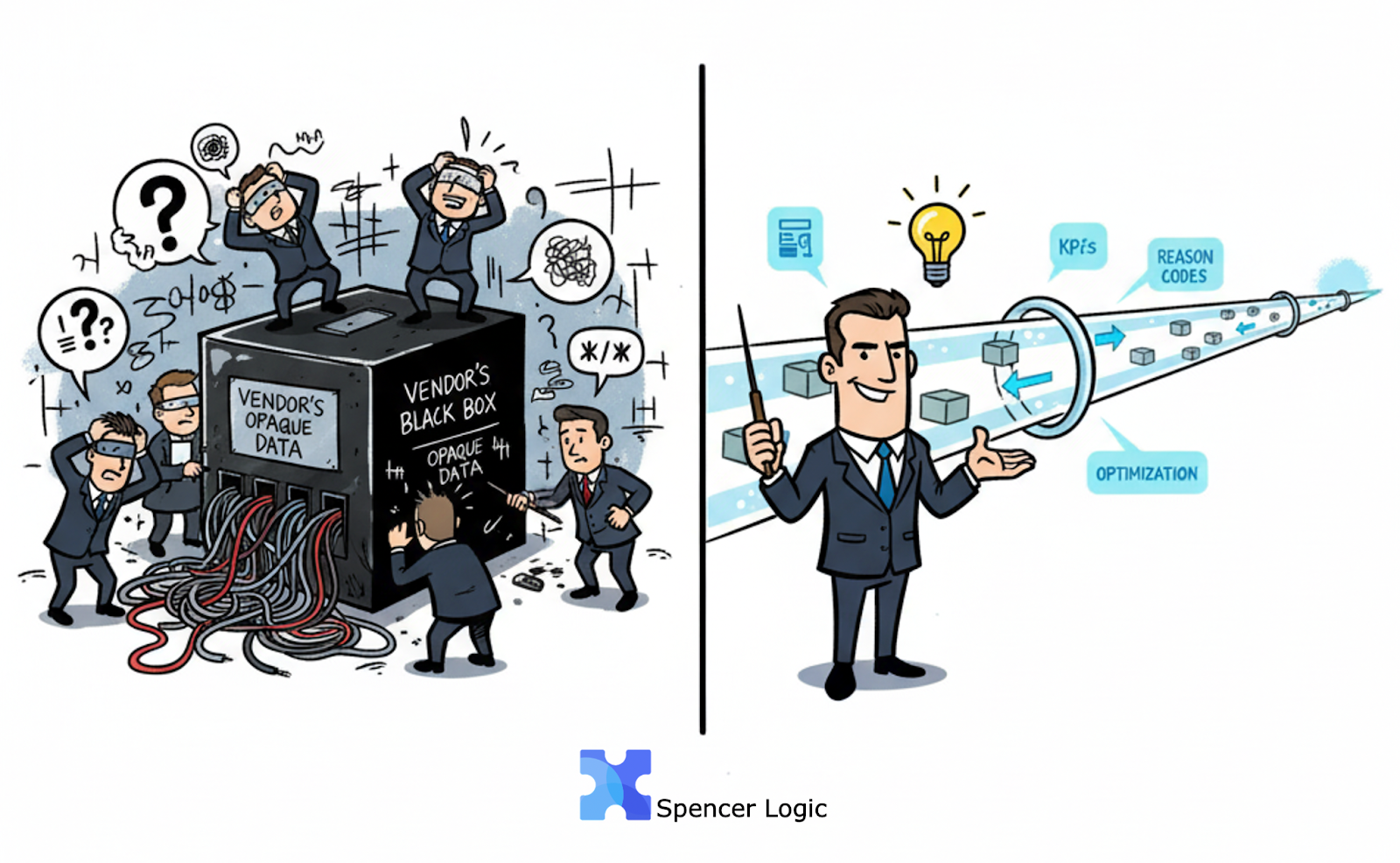

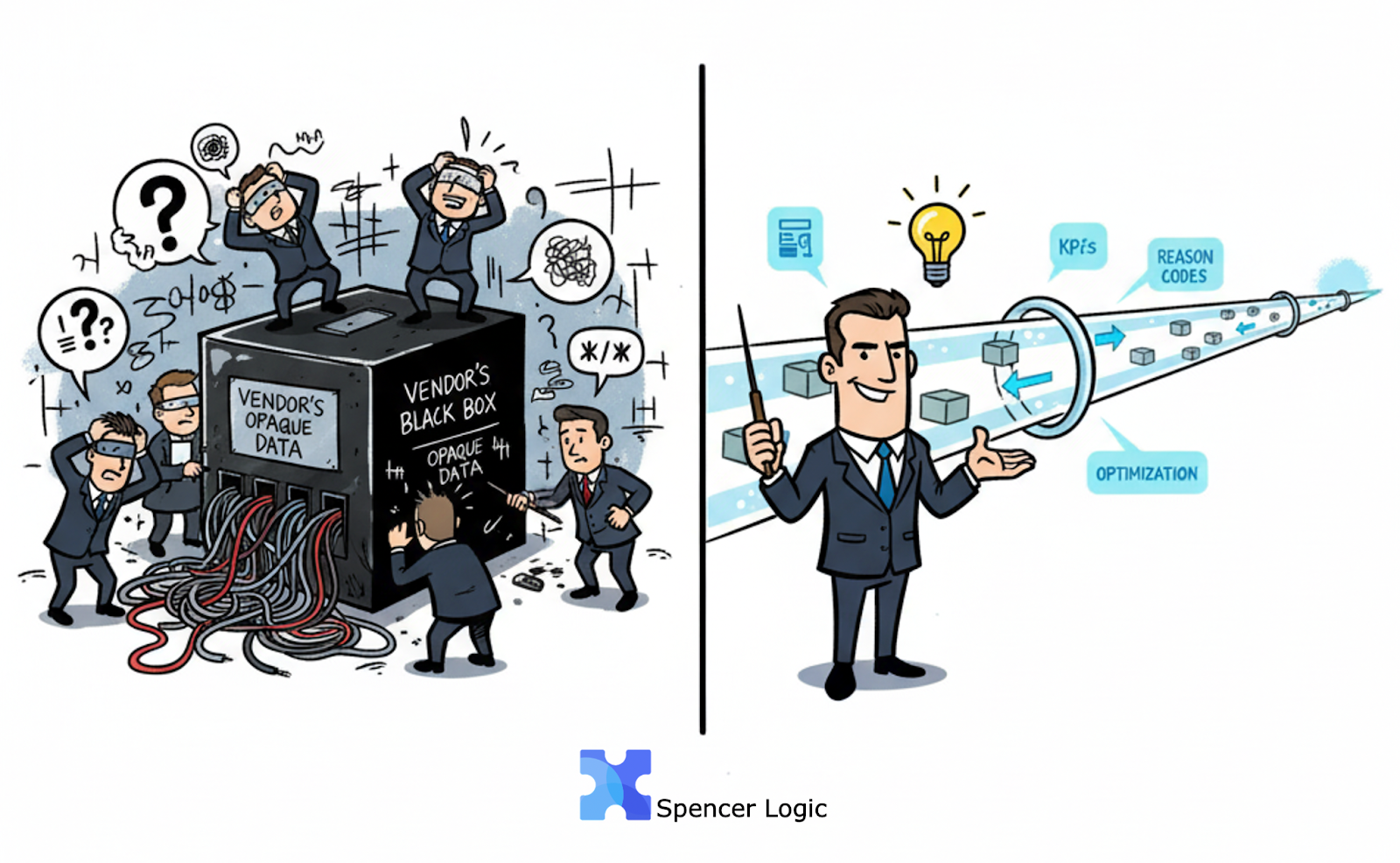

Why Traditional Bridge Architectures Fall Short

Legacy bridges were often designed when trading volumes were lower and infrastructure simpler. They relied on single-threaded processing and generic network protocols that introduced unnecessary delay. Data compression, logging, and translation layers were frequently placed in the execution path, slowing down order transmission.

Moreover, these systems lacked intelligent monitoring. When latency spiked due to network congestion or provider issues, there was no real-time adaptation. Orders queued, fills delayed, and brokers absorbed the reputational cost.

In contrast, modern bridges are purpose-built for distributed execution environments. They combine multi-threaded processing, proximity hosting, and asynchronous communication to ensure that the bridge adds almost no measurable latency to the trading cycle.

Anatomy of a Low-Latency Bridge

A high-performance bridge architecture rests on three pillars: connectivity, processing, and routing intelligence.

Connectivity begins with colocation. The bridge should be physically hosted near major liquidity venues — London (LD4), New York (NY4), Tokyo (TY3), or Singapore (SG1) — to reduce round-trip time. Direct cross-connects to liquidity providers avoid the unpredictable hops of public internet routes.

Processing involves efficient data handling. Orders must bypass unnecessary layers of abstraction. Memory-resident message queues, kernel-bypass networking, and optimized FIX engines allow the bridge to process thousands of messages per second without bottlenecks.

Routing intelligence ensures that once data moves quickly, it also moves wisely. A bridge with built-in smart order routing constantly evaluates which LP offers the fastest and most stable execution path, dynamically adjusting during volatility or outages.

Together, these components form an infrastructure where order execution happens not only fast but predictably — a distinction that defines institutional-grade performance.

Measuring and Managing Slippage

Reducing slippage is not only about speed; it is about precision and feedback. A well-engineered bridge collects granular data on every transaction: timestamp at order receipt, routing destination, time-to-acknowledgment, and final fill price. By analyzing this data in real time, brokers can pinpoint the sources of slippage — whether it arises from LP performance, network latency, or internal routing logic.

Bridges designed by Spencer Logic include performance dashboards that display these metrics in microsecond resolution. This level of visibility allows brokers to make informed adjustments: replacing underperforming LPs, refining routing rules, or rebalancing aggregation priorities. Over time, this closed feedback loop transforms execution optimization into a continuous process rather than a reactive one.

Adaptive Routing and Latency Compensation

Modern bridge architecture goes beyond static routing tables. Adaptive routing uses machine learning and predictive modeling to anticipate which venues are likely to respond fastest given current market conditions. If one LP’s latency increases by 30%, the bridge reroutes orders automatically without human intervention.

Latency compensation mechanisms also help synchronize execution timing between geographically distant venues. By timestamping every order event, the bridge can adjust routing to equalize latency across regions, ensuring fair fills for all traders regardless of server location.

Infrastructure Redundancy and Uptime

Reducing latency is meaningless without reliability. A true low-latency bridge must maintain uptime above 99.99%, achieved through redundant routing nodes, failover clusters, and automated heartbeat monitoring. In the Spencer Logic architecture, multiple regional servers replicate state data in near real time. If one environment fails, orders automatically reroute through the next-closest hub without user disruption.

This architectural redundancy not only prevents outages but also distributes network load, keeping latency consistently low during peak trading hours.

Business Outcomes of Low-Latency Execution

Latency reduction yields tangible commercial benefits. Traders who experience predictable fills trade more frequently and with larger volumes. Support tickets decline, operational risk drops, and marketing costs per active client decrease as retention improves.

For brokers running hybrid or A-book models, consistent execution also improves hedging efficiency. Orders reach counterparties fast enough to maintain exposure balance, reducing risk and increasing profitability.

At the institutional level, superior latency metrics become a sales argument of their own. Prime-of-prime partners, introducing brokers, and white-label clients evaluate execution infrastructure as part of their due diligence. A bridge that demonstrates measurable latency advantage enhances a broker’s credibility in every negotiation.

The Spencer Logic Approach

Spencer Logic’s bridge architecture was designed specifically to address the twin challenges of latency and slippage in multi-asset environments. By combining colocation, smart order routing, and continuous performance analytics, it maintains sub-millisecond routing efficiency even during volatile conditions.

Our monitoring layer provides brokers with full transparency over latency sources, while automated optimization ensures that routing adjusts dynamically — without manual configuration or downtime. The result is a system that not only executes fast but learns to execute faster over time.

Conclusion

Latency and slippage are not abstract technical concerns; they are the hidden costs that separate brokers who scale from those who stagnate. In an era where traders can measure execution quality themselves, only a modern bridge architecture can provide the speed, reliability, and transparency that competitive markets demand.

Spencer Logic continues to push the frontier of low-latency trading infrastructure, delivering bridging solutions that combine intelligent routing with institutional-grade performance monitoring. To learn how our architecture can strengthen your execution quality and client trust, explore our Bridging Solution.