TL;DR

- The Challenge: Financial markets are fragmented; relying on a single liquidity source guarantees suboptimal pricing and poor fills (slippage/rejections) for traders.

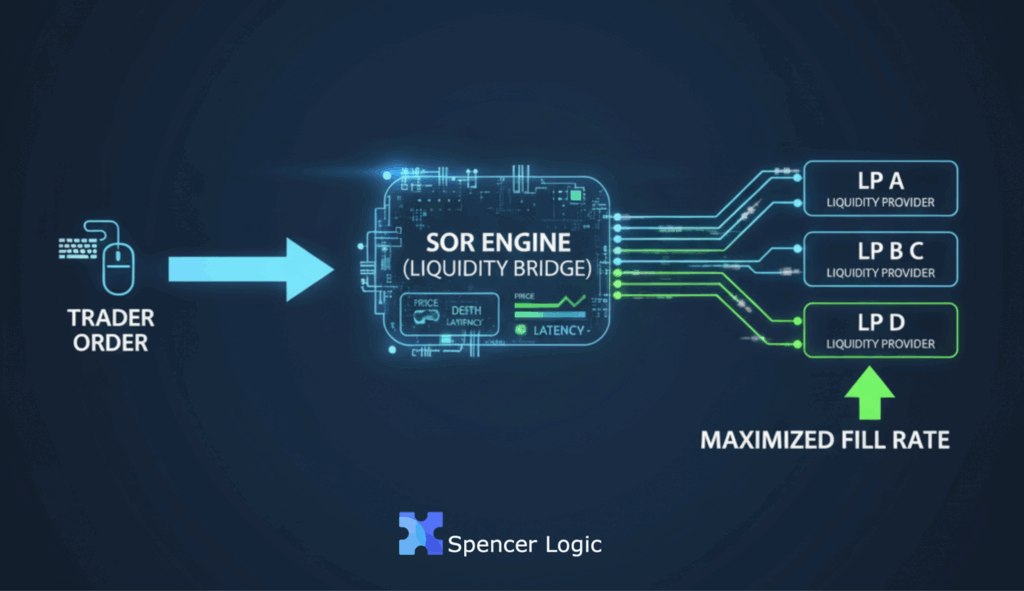

- The Solution: Smart Order Routing (SOR), integrated within a modern Liquidity Bridge, instantly compares all connected liquidity feeds (price, depth, latency) to find the absolute best execution path.

- Key Functionality: SOR acts as an intelligent traffic controller. It can split large orders across multiple LPs, reroute partially filled trades, and dynamically avoid venues with stale quotes or high latency.

- The Benefit: SOR maximizes fill rates, drastically reduces negative slippage, and allows brokers to offer better spreads by optimizing execution, directly boosting client retention and profitability.

- Spencer Logic: Our bridge embeds SOR deeply, using real-time execution statistics to adapt and learn, transforming the bridge from a passive connector into an adaptive best-execution engine.

Smart Order Routing in Bridging: How It Maximizes Fill Rates

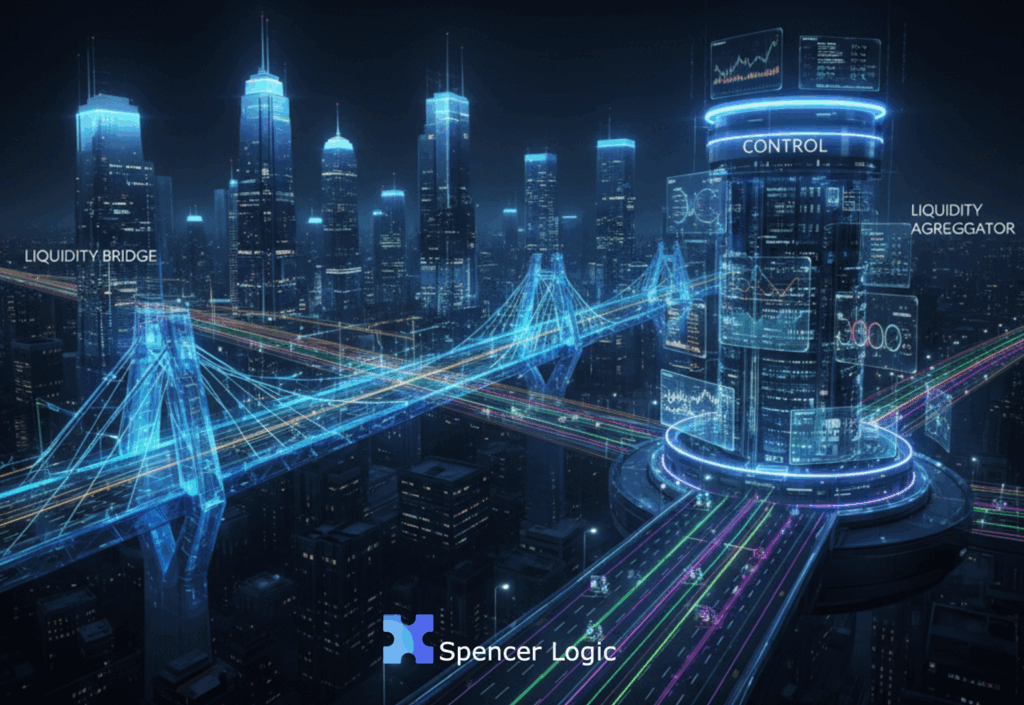

In today’s fiercely competitive and fragmented financial markets, the difference between a successful trade and a frustrated client often comes down to milliseconds and a fraction of a pip. Price and liquidity are not static; they can vary dramatically from one trading venue to another within the blink of an eye. Brokers that remain reliant on a single liquidity source are actively risking giving their clients inconsistent fills, wider spreads, and frustrating trade rejections.

The solution to this critical infrastructure challenge is Smart Order Routing (SOR). This technology is no longer a luxury for institutional firms; it is one of the most powerful, non-negotiable features built into modern retail liquidity bridges. SOR is the intelligence layer that guarantees a broker’s commitment to “best execution.”

The Challenge of Fragmented Liquidity

The foreign-exchange (FX), CFDs, and cryptocurrency markets are decentralized ecosystems. Prices flow continuously from dozens of liquidity providers (LPs), prime-of-primes, ECNs, and market makers. Each of these venues quotes slightly different bid and ask prices at any given moment.

A broker connected to only one source is like viewing the entire market through a narrow pinhole. During periods of high volatility, major news events, or thin market hours, this limitation is severely exposed. The result is often detrimental to the trader:

- Slippage: The execution price differs negatively from the requested price.

- Rejected Orders: Orders cannot be filled quickly enough at the quoted price.

- Trader Frustration: Inconsistent and poor execution quality erodes trust and encourages clients to seek rival brokers.

To survive and thrive, brokers must access and manage this fragmentation effectively.

What Smart Order Routing Actually Does

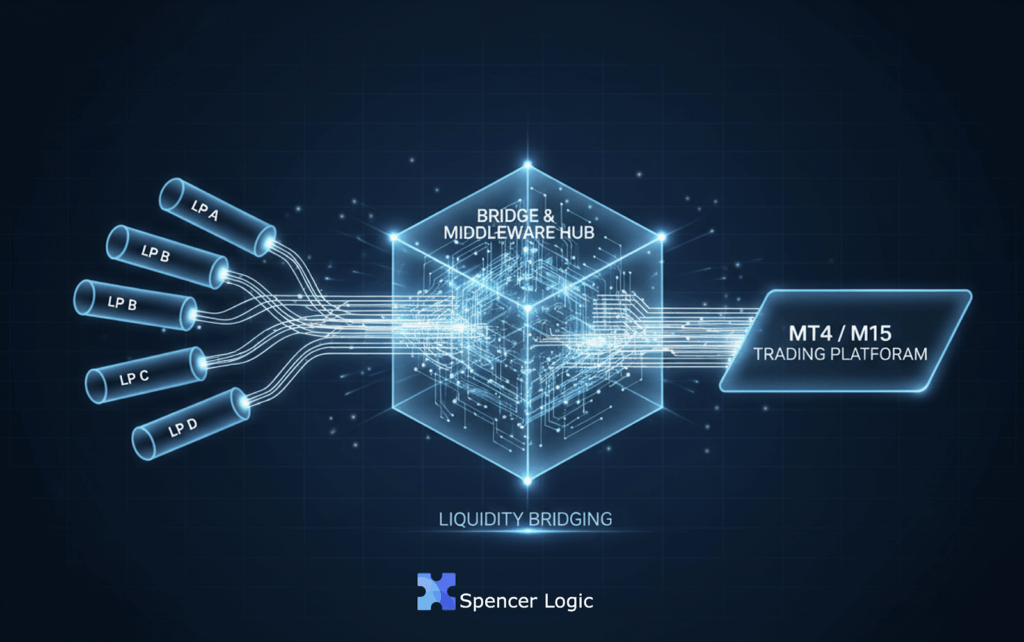

At its core, Smart Order Routing is the decision-making engine residing inside the liquidity bridge. It is a sophisticated set of algorithms designed to execute one primary goal: to find the absolute optimal path for every single order, every single time.

When a trader initiates a ‘Buy’ or ‘Sell’ order on their platform (MT4, MT5, WebTrader), the SOR module instantly springs into action. Its process involves:

- Real-Time Data Aggregation: It simultaneously compares all connected liquidity feeds, evaluating key metrics for each LP: price (the best bid/ask), depth (how much volume is available at that price), and latency (how quickly the LP typically responds).

- Best Path Determination: It applies pre-set or dynamic routing logic to determine the most beneficial execution path. This ensures orders are sent to the LP offering the best combination of price and speed.

- Order Slicing (Sweeping): For large orders that exceed the available volume at the best price, the SOR can intelligently split (slice) the order across several LPs to ensure maximum fill at the best possible weighted average price.

- Quote Health Monitoring: SOR continuously monitors the health of the connection and the quality of quotes from each LP. It will instantly reroute an order if a venue shows unusually high latency, stale quotes, or a high rejection ratio.

In essence, SOR transcends the role of a passive connection tool. It behaves like an air-traffic controller—continuously monitoring the financial skies, selecting the safest, fastest, and most profitable route for every trade.

Core Benefits of SOR for Brokers and Traders

Implementing effective SOR functionality translates directly into measurable commercial advantages for the broker and superior execution for the client, creating a powerful win-win solution.

| Benefit | Description | Business Impact |

| Maximized Fill Rates | Routing logic looks deep into the order book and across all LPs, ensuring orders find execution even when market liquidity is thin or fragmented. | Higher trading volumes, more revenue, and fewer abandoned trades. |

| Reduced Negative Slippage | By continuously monitoring latency and avoiding venues with quotes that lag the true market price, SOR minimizes the chance of executing at a worse price. | Protects client capital, builds trader confidence, and supports algorithmic trading. |

| Better Overall Pricing | SOR compiles the absolute top-of-book quotes from all sources, allowing the broker to deliver tighter, more competitive spreads without cutting into their own markups. | Key competitive differentiator, attracts high-volume traders. |

| Enhanced Risk Management | The SOR logic can be configured to manage the broker’s risk exposure by directing certain order types (e.g., large volume) to specific hedging LPs. | Provides control and stability, particularly during major volatility. |

The Spencer Logic Bridge: An Adaptive Execution Engine

A truly modern liquidity bridge, such as those offered by Spencer Logic, doesn’t just incorporate SOR—it embeds this intelligence deeply into its core architecture. This means the system is not static; it is adaptive.

Spencer Logic’s SOR engine monitors a rich array of real-time execution statistics: average latency per LP, instrument-specific rejection ratios, and overall quote quality consistency. Based on this data, the system automatically adjusts its routing rules.

- Learning Capability: The system effectively learns which LPs perform optimally for specific instruments (e.g., LP ‘X’ is best for EURUSD during European hours, while LP ‘Y’ is best for Crypto on weekends).

- Dynamic Re-optimization: If a previously reliable LP begins to degrade in performance (e.g., latency spikes), the SOR instantly de-weights that LP and redirects traffic until performance recovers.

This intelligence transforms the bridge from a simple data connector into a protective, adaptive execution engine that maximizes trade success for clients while shielding the broker from the high costs associated with poor execution quality.

Business Impact: The ROI of Best Execution

For a broker like the one you operate at Spencer Logic, efficient SOR translates directly into quantifiable business gains:

- Stronger Client Retention: Consistent, fast, and fair fills are the single biggest driver of trader satisfaction and loyalty. Fewer rejections mean fewer support tickets and fewer complaints.

- Market Share Gains: By offering demonstrable best execution, the broker gains a powerful marketing narrative—moving beyond simple price wars to competing on the quality of service.

- Lower Operational Cost: Automated, intelligent routing reduces the need for manual intervention and oversight of execution feeds, lowering personnel costs.

- Scalability: A robust SOR can easily incorporate new LPs and asset classes (FX, metals, crypto, indices) without disrupting existing infrastructure, making expansion seamless.

In an environment where traders can effortlessly switch brokers with a single click, these micro-advantages of superior execution compound into significant market share gains and long-term profitability.

Conclusion

Smart Order Routing is not an optional add-on; it is the silent, strategic engine of best execution in the modern brokerage world. Integrated within a state-of-the-art liquidity bridge, SOR ensures that every client trade finds its optimal destination, maximizing fill rates, minimizing slippage, and protecting the integrity of both sides of the order book.

Spencer Logic’s integrated bridging stack leverages these advanced routing algorithms to deliver consistently fast, reliable execution. For any broker looking to solidify client trust and gain a definitive competitive edge in the market, investing in SOR is the clearest path to success.