By Logic Pulse | Spencer Logic Insights Series

Recent headlines have screamed of geopolitical tensions and unprecedented market uncertainty. A new wave of unpredictability is sweeping across global markets, leaving even the most seasoned analysts scrambling for answers. From commodity price shocks to sudden shifts in investor sentiment, the once-reliable patterns of market behavior have been thrown into disarray. This is not just a passing storm; it is a fundamental shift in the trading landscape.

For retail brokers and crypto exchanges, this environment presents a formidable challenge. The old way of doing business—relying on a single liquidity provider and hoping for the best—is no longer a viable strategy. When market volatility surges, single-source liquidity can dry up in an instant, leading to wider spreads, painful slippage, and an inability to execute trades at the best possible price. These are not merely operational hiccups; they are direct threats to your brand reputation, client loyalty, and, ultimately, your bottom line. Your clients, empowered by real-time information, are acutely aware of execution quality. They will not hesitate to move their capital to a brokerage that can deliver tighter spreads and faster, more reliable fills. In this new era, your clients’ trust is built on your ability to perform under pressure.

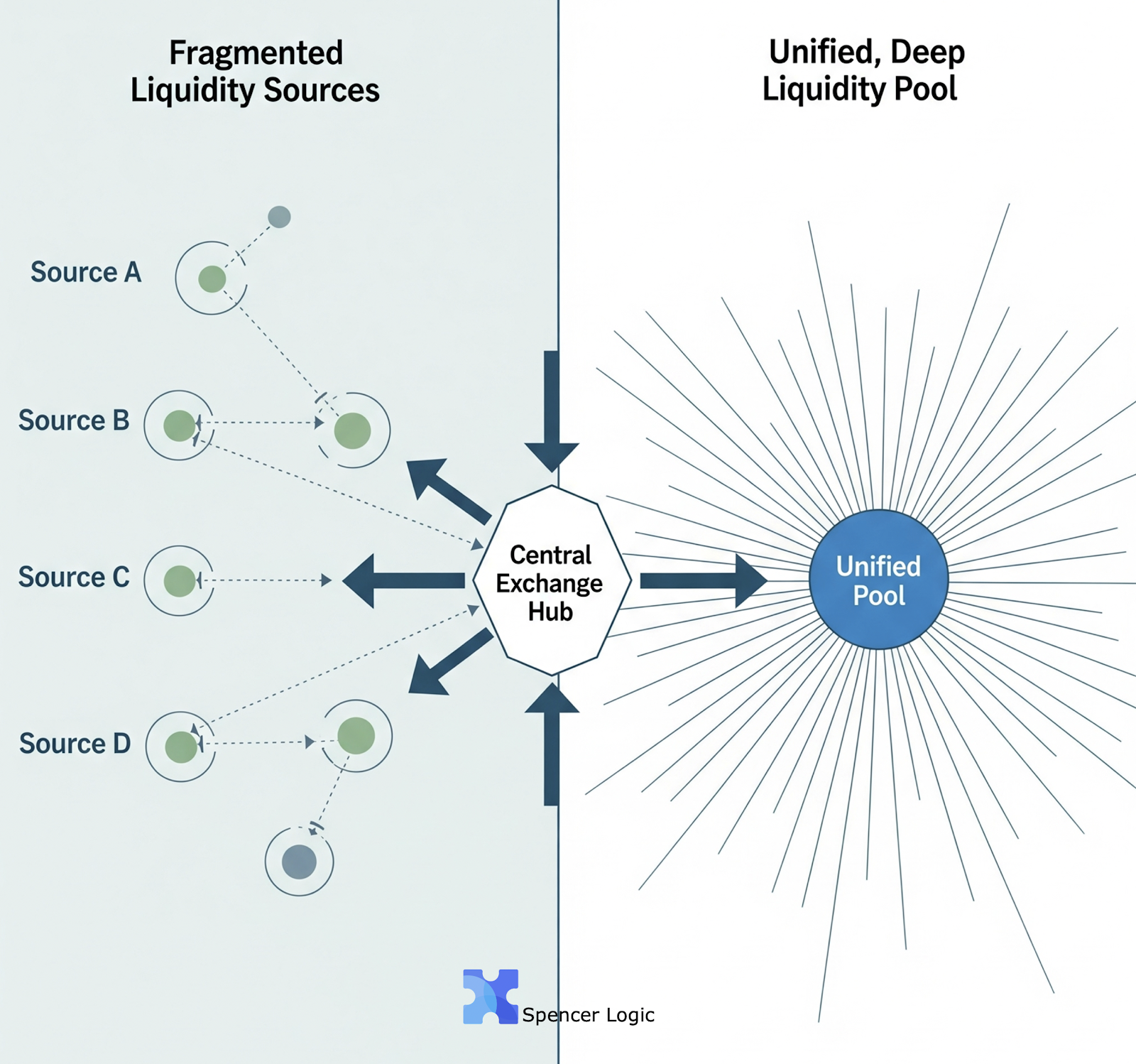

This is where the true value of robust liquidity aggregation reveals itself. Liquidity aggregation is no longer a luxury for the elite few; it is a critical necessity for any brokerage that intends to survive and thrive. By aggregating multiple liquidity streams from various top-tier providers, you create a deep, resilient pool of capital that can withstand even the most violent market swings. This multi-source approach ensures that even if one provider pulls back, others are ready to fill the void, guaranteeing a seamless trading experience for your clients.

Furthermore, true liquidity aggregation allows you to become a price maker, not just a price taker. With a powerful price engine, you can synthesize the best bids and offers from across your aggregated pool, offering your clients the most competitive prices in the market. This not only improves their trading experience but also gives you a significant edge over competitors who are still operating with outdated, single-source models. The benefit is twofold: your clients gain from superior pricing and execution, and you gain from increased trading volume and a reputation as a broker who prioritizes their success.

In this market, the ability to mitigate risk is just as important as the ability to secure liquidity. A sophisticated risk management system, integrated with your liquidity bridge, allows you to monitor and manage your exposure in real time. You can set granular parameters, manage hedged positions, and protect your firm from unexpected market events. Without these tools, you are essentially flying blind, leaving your firm vulnerable to the very volatility that your clients are seeking to capitalize on. The current market is unforgiving, and a lack of preparation can lead to catastrophic losses.

This is not a theoretical discussion. This is a call to action. The brokers who are prepared for this new reality are the ones who are already investing in technologies that deliver on these promises. They are the ones who will attract new clients and retain their most valuable ones. They understand that the old guard of Wall Street may be baffled by market behavior, but they, the modern, agile brokers, are armed with the tools to dominate it.

A Better Way to Operate: The Spencer Logic Solution

In this chaotic environment, your brokerage or crypto exchange needs more than just technology; it needs a partner. Spencer Logic understands the challenges you face because we have built our entire suite of solutions to solve them. Our technology is not just an add-on; it is the core infrastructure you need to turn today’s market challenges into your greatest opportunities.

Our Liquidity Aggregation solution is engineered to deliver the tightest spreads and deepest liquidity available in the market. We seamlessly connect you to a diverse network of top-tier liquidity providers, ensuring that your clients always get the best possible prices, regardless of market conditions. This is the foundation of a fair and transparent trading environment.

But we don’t stop there. Our advanced Bridging technology, combined with our intelligent Price Engine, ensures that every single order is executed with minimal latency and maximum efficiency. We eliminate the inefficiencies that lead to slippage and client frustration, giving you a competitive edge that builds client trust and boosts trading volume.

Furthermore, our robust Risk Management System provides you with the control you need to navigate this new era of volatility. You can monitor positions, set automated controls, and protect your firm’s capital from undue exposure. This isn’t just about security; it’s about giving you the confidence to grow your business aggressively, knowing you are protected.

The market has changed. The old rules no longer apply. The time to act is now. Do not wait for a catastrophic market event to expose the weaknesses in your current setup. Spencer Logic offers a proven, scalable, and customizable solution that will empower you to not only survive, but to thrive in the face of unprecedented volatility. Let us show you how our technology can make your brokerage stronger, more efficient, and more profitable.