By Logic Pulse | Spencer Logic Insights Series

Introduction

In the past, algorithmic trading was a fortress — gated by PhDs, $10,000/month data feeds, and quant teams camped inside Wall Street towers. Retail traders? They were spectators at best.

But not anymore.

In 2025, the game has flipped.

Now, any trader with a laptop, a ChatGPT prompt, and 30 spare minutes can spin up a working strategy — backtested, optimized, and deployed live. Reddit threads overflow with Pine Script builds. Telegram bots copy top strategies in real-time. QuantConnect, TradeGPT, and dozens of other low-code platforms have become the new trading floor.

The lines between institutional and retail are blurring — fast.

This isn’t just “retail getting smarter.” It’s retail going programmatic — turning strategies into software, and software into scale.

And that scale has consequences.

If you’re a broker — especially in FX, CFD, or crypto — this matters more than you think. Because these new-age traders don’t trade like humans. They don’t hesitate. They don’t panic. And they certainly don’t tolerate slow execution or stale liquidity.

They’re not trading on intuition — they’re trading on logic.

Which means your infrastructure better be as smart — and as fast — as they are.

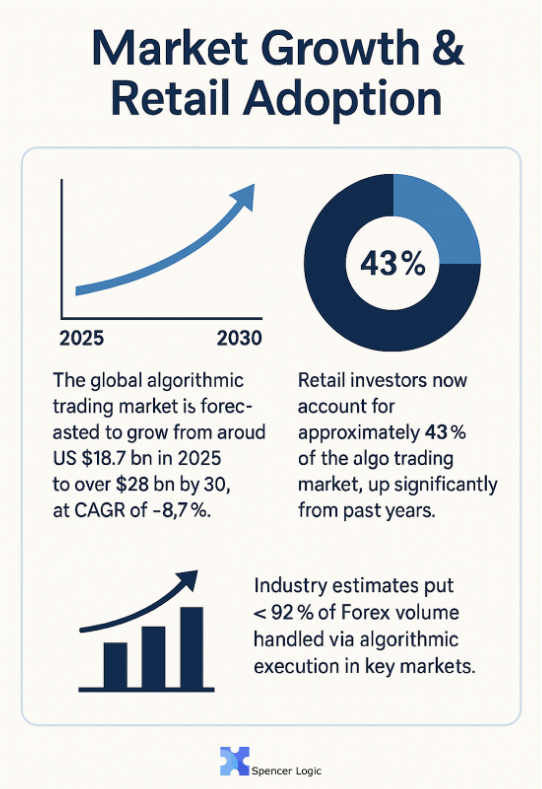

Market Growth & Retail Adoption

- The global algorithmic trading market is forecasted to grow from around US $18.7 bn in 2025 to over $28 bn by 2030, at a CAGR of ~8.7 %.

- Retail investors now account for approximately 43 % of the algo-trading market, up significantly from past years.

- Industry estimates put < 92 % of Forex volume handled via algorithmic execution in key markets.

Technology Drivers Behind the Boom

- AI + LLMs (like GPT-4o) enable algorithm logic generation through natural language, bypassing coding hurdles.

- Open-source frameworks like QuantConnect offer cloud-based backtesting and multi-asset support with minimal engineering.

- Pre-built algo templates, tutorials, and community-shared strategies lower the entry barrier— traders can launch bots within hours.

Structural Impact on Broker Infrastructure

Retail algo-traders create demand profiles that expose friction points in traditional brokers:

1. Order Routing Strain

Bots generate rapid-fire orders at specific price levels. Static routing logic leads to latency slippage and failed fills under surges.

2. Liquidity Capture Difficulty

When multiple bots hit shallow order books, price gaps emerge instantly. Lack of aggregation across FX, CFDs, futures means poor liquidity defense.

3. Latency Sensitivity

Bots expect sub-millisecond execution windows. Even minor delays yield lost opportunities.

4. Risk Accumulation Blind Spots

Multiple bots, correlated signals, and overlapping positions can quickly breach margin thresholds. Brokers without real-time risk visibility expose themselves to outsized losses.

Dubai Brokers Are Watching Closely

Dubai’s broker community is buzzing. DFSA-regulated firms are rolling out MT5 and CQG platforms to serve retail algo traders and institutional futures clients alike.

- Brokers offering MT5 + CQG Gateway gain access to CME, ICE, NYMEX, and EUREX liquidity — ideal for futures, commodities, and hedging strategies.

- Dubai firms aim to attract elite retail bots and institutional flows simultaneously — a dual focus requiring execution-grade routing and risk architecture.

What Brokers Need to Thrive

To compete, brokers must evolve across infrastructure, execution, risk, and UX:

- Dynamic Smart Order Routing that considers depth, fees, and latency across venues.

- Liquidity Aggregation to unify books from FX, CFD, crypto and potentially exchange futures.

- Real-Time Risk Engine tracking correlated exposures and margin usage live.

- Algorithm-friendly execution interface via MT5-CQG Gateway with automated session syncing, margin, and order handling logic.

Why INVEST (Social Trading Platform) Matters Too

Not all users code bots — many want to follow proven strategies. Spencer Logic’s INVEST social trading platform bridges this gap:

- Algorithm creators monetize performance by sharing strategies.

- Retail traders copy high-performers without coding.

- Brokers build retention and credibility by fostering community and transparency.

Final Thought

The retail algorithmic wave isn’t a fad — it’s fundamentally reshaping trading ecosystems:

- Execution demands spike,

- Risk velocity accelerates,

- Community and strategy sharing become retention pillars.

Brokers who don’t adapt risk being outclassed by those who combine quant-level execution, community-led retention, and smart infrastructure.

Built for the AI-powered trade era, Spencer Logic powers brokers with:

- Smart order routing

- Liquidity aggregation

- Real-time risk engine

- MT5-CQG gateway integration

- INVEST social trading platform

Want an infrastructure audit for algotrader stress testing?

→ Contact us via Live Chat.