By Logic Pulse | Spencer Logic Insights Series

TL;DR

- Liquidity Bridging is the essential middleware that connects your trading platform () to multiple institutional liquidity providers, acting as the core of modern execution.

- It’s no longer optional: In today’s market, clients demand instant execution and tight spreads—a bridge is the price of entry to attract and retain serious traders.

- The core benefits are tangible: Achieve tighter spreads (via quote aggregation) and lower latency (via Smart Order Routing), directly boosting your competitiveness.

- A bridge enables sophisticated risk management (A-book, B-book, Hybrid models) and ensures scalability for integrating new asset classes like crypto.

- Spencer Logic offers a turnkey bridging solution designed specifically for emerging and scaling brokers, providing institutional-grade performance without the complexity.

In today’s trading environment, clients expect brokers to provide more than just access to the markets. They demand near-instant execution, spreads that remain competitive even in volatile conditions, and the ability to trade across multiple asset classes without friction. Meeting these expectations is no longer optional — it is the price of entry for brokers who want to attract and retain serious traders. Yet, achieving this level of performance is not possible with trading platforms alone. This is where liquidity bridging comes into play.

A liquidity bridge is more than a piece of technical infrastructure; it is the invisible backbone that connects brokers to the global markets. By linking trading platforms like MT4 and MT5 directly to liquidity providers or prime-of-prime brokers, a bridge enables brokers to deliver faster, more reliable, and more cost-effective execution to their clients. Understanding what liquidity bridging is, how it works, and why it matters can help emerging brokers make smarter technology decisions and build a stronger competitive edge.

Understanding Liquidity Bridging

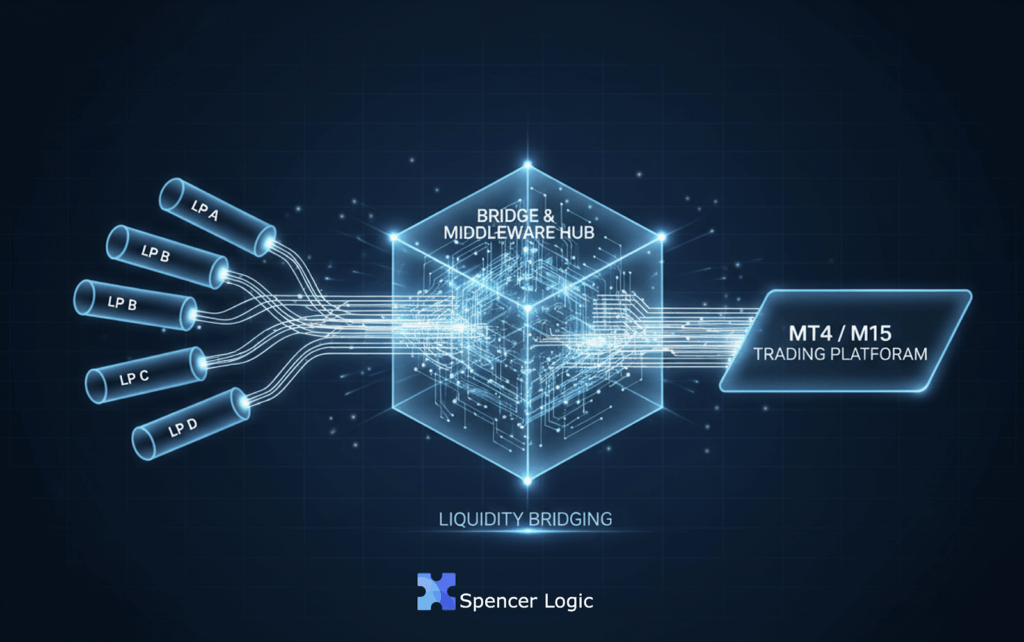

At its simplest, liquidity bridging is middleware that acts as a gateway between a broker’s trading platform and the broader liquidity ecosystem. Instead of relying on limited in-house liquidity or a single external provider, the bridge makes it possible to connect to multiple sources of institutional-grade liquidity. Orders placed by traders on the platform are seamlessly transmitted through the bridge, routed to the most suitable liquidity provider, and then executed at the best available market conditions.

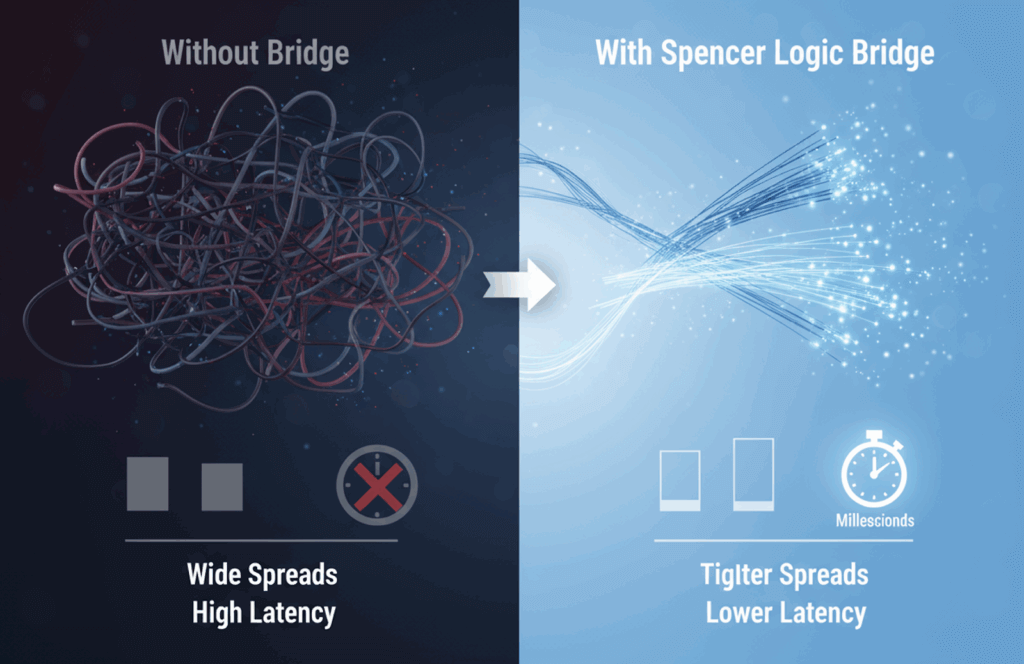

Think of the bridge as the financial markets equivalent of a highway interchange. Without it, traffic would be forced to bottleneck through a single road, slowing down execution and limiting capacity. With the bridge, order flow can be distributed across multiple lanes, ensuring faster throughput, smoother traffic, and less risk of costly congestion. This technical role is critical because, in electronic trading, every millisecond counts. Even small delays in execution can translate into slippage, wider spreads, or missed opportunities, particularly for high-frequency or scalping strategies.

Why Brokers Need a Bridge

For brokers, the question is not whether liquidity bridging is useful but whether they can realistically operate without it. Retail trading has grown more sophisticated in recent years, with clients demanding performance once reserved for institutional traders. Without a bridge, brokers are left with limited routing options and minimal control over how orders are executed. This creates risks not only for client satisfaction but also for the broker’s own profitability and long-term competitiveness.

A liquidity bridge addresses several critical needs. It reduces latency by ensuring orders travel the most direct route possible to liquidity providers. It optimizes spreads by aggregating quotes from multiple sources, giving brokers the ability to offer better bid/ask pricing. It also scales with the broker’s business, supporting the addition of new asset classes such as crypto or CFDs without requiring a full rebuild of infrastructure. Finally, it enables sophisticated risk management strategies, including A-book, B-book, or hybrid execution models, helping brokers balance profitability with client outcomes.

How a Liquidity Bridge Works

While the internal mechanics can be complex, the logic behind a liquidity bridge is straightforward. When a client places an order in MT4, MT5, or another platform, the order does not go directly to the market. Instead, it is transmitted to the bridge, which acts as the broker’s decision-making hub. From there, the bridge evaluates available liquidity sources and determines how best to execute the order. In many cases, it uses smart order routing (SOR) algorithms to compare quotes from multiple providers and automatically select the optimal match.

Once the order is routed and filled by the liquidity provider, the confirmation is sent back through the bridge and recorded in the trading platform. All of this occurs in milliseconds, invisible to the trader but vital for the broker’s infrastructure. Beyond order execution, modern bridges also provide features such as monitoring dashboards, risk controls, and detailed transaction cost analysis, giving brokers real-time visibility into their execution quality. This ability to both manage and measure execution is increasingly important in markets where regulators emphasize best execution and transparency.

The Tangible Benefits of Bridging

The true power of liquidity bridging lies in the tangible advantages it delivers to both brokers and their clients. First and foremost, bridging reduces slippage by ensuring that executed prices align as closely as possible with the prices quoted on screen. In volatile markets, this difference can make or break a trading strategy, and traders notice quickly when execution quality is poor.

Bridging also lowers latency, with leading solutions capable of completing execution cycles in a few milliseconds. For brokers targeting active traders — scalpers, algorithmic traders, and professionals using automated strategies — low latency is not just an advantage but a necessity. Beyond speed, bridging provides access to deeper liquidity by aggregating quotes from multiple sources, which translates directly into tighter spreads. Better spreads not only attract traders but also improve the broker’s competitive positioning in a crowded marketplace.

Finally, a bridge enables transparency and regulatory alignment by giving brokers tools to track and report on execution quality. This supports compliance with best-execution obligations while also offering brokers insights into how their order flow behaves, which providers perform best, and where hidden costs might be creeping in.

Clearing Up Misconceptions

Because bridging is highly technical, misconceptions are common. One of the most frequent is the belief that a liquidity bridge and a liquidity aggregator are the same. While both play a role in connecting brokers to external liquidity, an aggregator focuses primarily on combining price feeds from multiple sources to provide the best quote. A bridge, in contrast, serves as the broader infrastructure that handles not only pricing but also order routing, risk management, and execution reporting. In other words, the aggregator is often a component within the bridge, but the bridge itself delivers the complete connectivity package.

Another misconception is that only large, established brokers require bridging. In reality, emerging brokers benefit just as much, if not more, from bridging technology. Without it, they cannot realistically compete with better-funded competitors that already offer fast execution and institutional-grade pricing. Modern bridging solutions are designed to be scalable and cost-effective, making them accessible to brokers at any stage of growth.

A final myth is that bridging is overly complex or expensive to implement. While it is true that early-generation bridges required heavy customization and technical expertise, today’s turnkey bridging platforms have dramatically lowered the barriers to entry. Brokers can onboard quickly, integrate with their existing platforms, and immediately access advanced execution capabilities without building custom infrastructure.

How to Choose the Right Bridge Provider

Selecting the right liquidity bridge is a strategic decision that can shape a broker’s ability to compete and scale. Compatibility is a critical factor: the bridge must integrate seamlessly with the broker’s existing trading platforms, whether MT4, MT5, cTrader, or others. Stability is equally important, as even minor downtime can erode client trust and cause financial losses.

Another key consideration is customization. Brokers should look for providers that allow them to define routing rules, manage risk, and access detailed reporting dashboards tailored to their needs. Transparency in pricing models and ongoing technical support should also weigh heavily in the decision, as a strong support partner can make the difference between smooth operations and constant firefighting.

Finally, brokers should evaluate how the bridge provider approaches innovation. With the trading landscape evolving rapidly — from crypto derivatives to tokenized assets — working with a forward-looking provider ensures that the bridge remains an asset for the long term rather than a bottleneck that needs replacement after a few years.

Conclusion

Liquidity bridging is not a luxury or a niche tool; it is the fundamental infrastructure that allows brokers to meet modern client expectations. By delivering faster execution, tighter spreads, and deeper access to liquidity, a bridge enables brokers to stay competitive in a market where milliseconds and basis points matter. It also provides the transparency, scalability, and risk management capabilities that underpin sustainable growth.

For brokers weighing their next move, investing in a reliable liquidity bridge is one of the most impactful steps they can take. It unlocks immediate benefits in execution quality while also preparing the business to expand into new asset classes and client segments.At Spencer Logic, we specialize in bridging solutions designed for emerging and scaling brokers. Our technology delivers institutional-grade liquidity access, customizable execution models, and real-time monitoring, all in a turnkey package. If you are ready to provide your clients with the execution they demand while positioning your brokerage for long-term growth, we invite you to explore our Bridging Solution.