By Logic Pulse | The Science of Brokerage Operations

TL;DR for Busy COOs

- The Problem: Managing separate tech stacks for FX, Crypto, and CFDs (the “Three-Engine Problem”) creates operational chaos, increases risk, and drains resources, especially during volatility.

- The Solution: A unified Multi-Asset Liquidity Aggregation stack puts one “brain” behind all assets. This centralizes connectivity, smart order routing, risk management, and analytics into a single, robust system.

- The Proof: Our clients see immediate benefits. As one Head of Ops stated, they replaced constant “fire drills” with a single source of truth, leading to higher fill rates, lower slippage, and a more efficient team.

- The Path: Integration is fast and safe, taking days, not months. We use a phased go-live process (test, shadow, ramp) so you are always in control.

- The ROI: Fewer operational emergencies, better execution for VIP clients, and a leaner, more effective ops team focused on growth instead of maintenance.

In the early days of advertising, my mentors taught me a simple, powerful truth: people don’t buy a product. They buy a solution to a problem. They buy relief from a pain point.

And for far too long, the central pain point for multi-asset brokers and crypto exchanges has been the same: a sprawling, chaotic collection of disparate systems. A separate liquidity stack for FX. Another for crypto. A third for CFDs. Each with its own vendor, its own integration quirks, and its own unique way of failing at 3 a.m. on a Saturday.

I call this the Three-Engine Problem. You’ve seen it. It’s the late-night call from a panicked ops team member. It’s the fragile API bridge that breaks every time a vendor pushes an update. It’s the constant scramble to reconcile three different risk reports and three different post-trade workflows. It’s the silent, steady drain on your team’s time and your firm’s profits.

But what if you could put a single, intelligent brain behind all three? A unified command center that handles FX, Crypto, and CFDs with one elegant, robust solution?

This is not a theoretical exercise. It is the practical, profitable reality for firms who have embraced Multi-Asset Liquidity Aggregation.

A Tale of Two Brokers

Let’s consider two firms. The first, Broker B, operates the traditional way. Their FX desk connects via FIX to half a dozen LPs. Their crypto team manages REST and WebSocket feeds from four exchanges. Their CFD desk gets a proprietary feed from a third-party vendor.

Now, imagine the moment volatility spikes.

On Broker B’s floor, three different teams are scrambling. The FX desk is dealing with rejected orders from a last-look LP. The crypto desk is wrestling with an exchange’s rate limits after a sudden market move. The CFD desk is getting hammered by slippage. Three different problems, three different incident playbooks, and three teams trying to communicate with one ops manager who just wants to go home.

Now, let’s look at Client Alpha, a successful brokerage we’ve worked with for over a year. Before they partnered with us, they faced this exact chaos. Their CEO put it simply: “We were spending more time managing vendors than we were managing our clients. Our people were exhausted.”

Today, Client Alpha operates with a single, unified stack. When volatility hits, their ops team follows one workflow. When they need to add a new liquidity provider, it’s a single integration path, not a multi-week project. They have a unified view of their exposure, allowing them to make faster, more confident decisions.

Client Alpha’s Head of Operations shared this with us recently:

“Before, our tech stack was a Rube Goldberg machine. One thing broke, and the whole day became a fire drill. Spencer Logic simplified everything. We now have a single source of truth for all our liquidity, risk, and post-trade data. Our fill rates are up, our slippage is down, and most importantly, my team finally gets to focus on growth. It’s the single best operational decision we’ve made.”

This is the power of a single brain behind three books.

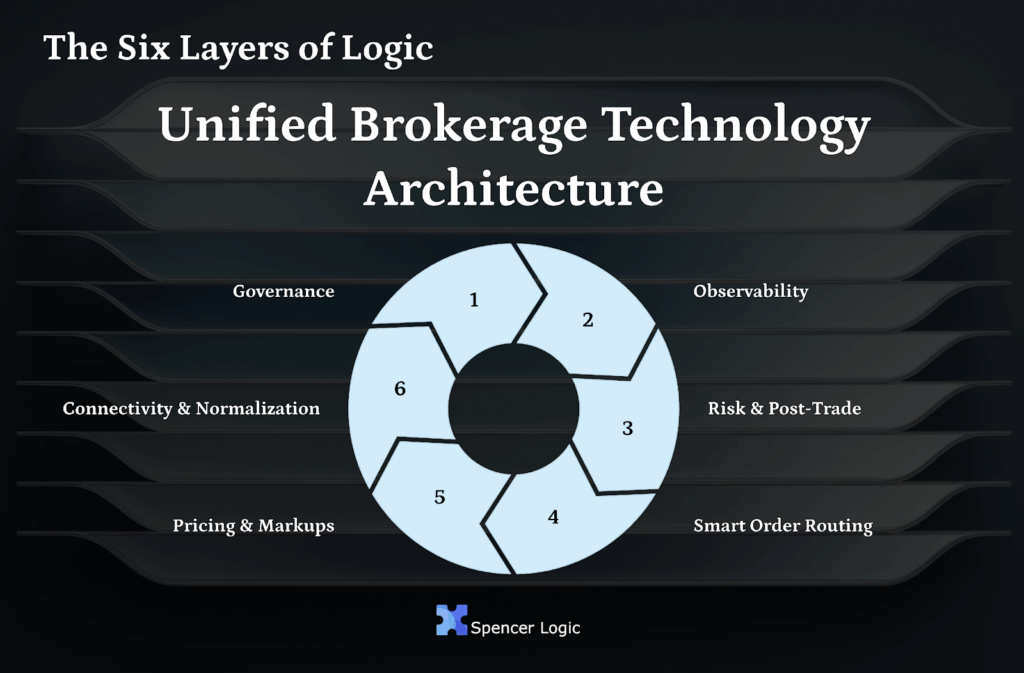

The Anatomy of the Solution: Six Layers of Logic

The solution isn’t magic; it’s methodical. It’s a carefully engineered system that keeps your desks independent yet coordinated.

- Connectivity & Normalization: This is the plumbing. It brings raw data from disparate sources into one standard format. FIX for FX/CFDs, REST/WebSocket for crypto, and even optional adapters for DeFi. No more mismatched symbols.

- Pricing & Markups: We aggregate depth from all venues. You then apply a single set of markup curves. Your quotes become consistent and fully within your control.

- Smart Order Routing (SOR): This is the genius layer. It doesn’t just pick the cheapest venue. It scores each one in real-time based on spread, depth, reliability, and fees, then automatically fails over when a stream degrades.

- Risk & Post-Trade: Your A/B/hybrid settings, exposure caps, and hedging rules all live in one place. Logs are fed directly into the BI stack you already use.

- Observability: We provide a clear view of the entire system, with alarms mapped to your existing incident playbook.

- Governance: You maintain a single, plain-English document explaining your routing logic for each asset class. Simple and transparent.

A Fast Path to Sanity: Integration in Days, Not Months

The most common misconception is that a project of this scale takes months. It doesn’t. We get you live quickly and safely.

- Day 1-3: Wire Up & Smoke Test. We connect to your core venues and validate the flow of quotes and orders.

- Day 3-5: Shadow & Tune. We run the system in a shadow mode, comparing performance against your existing setup while you tune the logic.

- Same Week: Phased Go-Live. You ramp up traffic gradually—10%, 25%, 100%—all behind automated health gates. You are always in control.

The end result? You don’t have to “migrate the world” on day one. You prove the stability on core symbols and expand at your own pace.

This is the power of science over superstition. You don’t have to trust our word; you can measure the superior outcomes for yourself, using your own analytics. It’s about replacing complexity with clarity, chaos with control.

This is the solution to the pain you face every day. It’s not a promise; it’s a proven path to a better business.