Launching a brokerage is one of the few ventures where the method of building the business dictates its ultimate performance. In FX/CFD markets, how you construct the infrastructure matters as much as what you offer. Many founders assume they simply need MT5/MT4, a CRM, a liquidity provider, and a KYC tool. They underestimate that the brokerage is an ecosystem, not a software bundle. Every component touches every other component; every integration affects execution, compliance, client experience, risk, and the broker’s long-term cost structure.

This is why the decision between turnkey, white label, and in-house build is not a small administrative choice—it is one of the defining strategic decisions of the entire business. Each path carries its own economics, operational strengths, scalability limits, and regulatory implications. A mistake here is not easily fixed later; brokers who choose poorly often spend years unwinding the consequences.

This article provides a complete comparative analysis, designed for founders, investors, and decision-makers. It blends consultancy-level insight with practical operational understanding, presenting not just what each model is, but what each model means for the economics and scalability of a brokerage.

Why This Comparison Matters More Than Most Founders Realize

Many new brokers enter the industry believing they can start small, spend little, and “upgrade later.” In reality, this mindset leads to operational bottlenecks, compliance failures, and costly migrations. The brokerage industry does not scale linearly. A system built for 100 clients often cannot support 1,000; a brokerage running on a white label cannot magically transition into a regulated multi-entity group without rewriting its foundation; an in-house build drains capital unexpectedly.

The model you choose becomes the architectural DNA of the company. It affects:

- launch speed

- capex vs opex structure

- control over execution

- regulatory credibility

- maintenance demands

- profitability models

- scalability ceilings

- risk exposure

- long-term valuation

The stakes are high.

The wrong model can delay growth by years.

The right model unlocks early traction and long-term scalability.

With that context, let’s define each approach clearly.

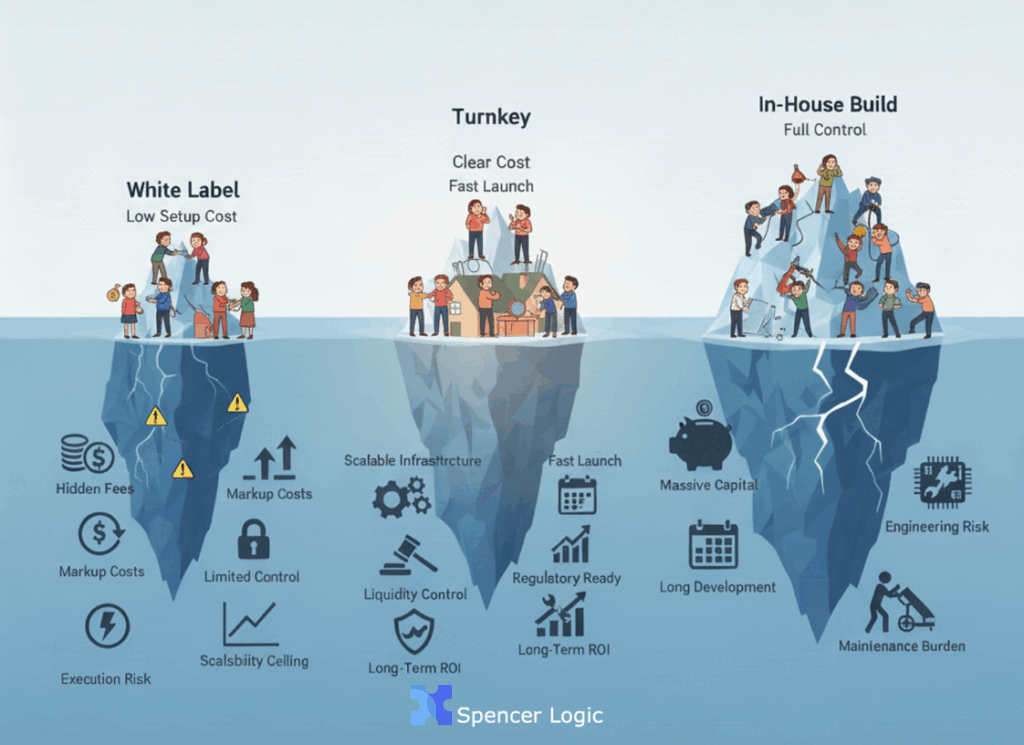

The Three Models at a Glance

Below is a simple table to orient the comparison (1 of 2 tables in this article):

| Model | What It Is | Typical Buyer | Core Advantage | Core Limitation |

| Turnkey | Full-stack stack (platform, liquidity, CRM, KYC, payments) pre-integrated | Growth-focused brokers | Fast deployment + control | Higher upfront than WL |

| White Label | Platform-only rebrand | Small, budget-limited brokers | Cheapest to start | No control, limited scalability |

| In-House Build | Fully custom brokerage infrastructure | Well-funded institutional players | Maximum control | Very expensive + slow |

This table simplifies reality. The true implications of each model become clear only when we analyze cost, control, risk, and long-term ROI in depth.

Understanding the Turnkey Model

A turnkey brokerage solution provides a fully integrated ecosystem: MT5/MT4, liquidity, bridge, CRM, onboarding, payments, compliance tools, hosting, monitoring, and operational workflows—all deployed within a prescribed structure.

What makes the turnkey model powerful is that it delivers the entire operating environment rather than just a platform. This means the broker begins with:

- a functioning execution engine,

- a compliant onboarding system,

- a synchronized CRM,

- a unified reporting structure,

- payment rails already approved,

- and a risk environment that can sustain volume.

The turnkey model is often misunderstood as being a “premium version of white label,” but this is not accurate. A turnkey setup is an operational backbone—not a platform lease. It is what institutional brokers use when they want to launch properly, without years of development or the fragility of first-year infrastructure.

Turnkey solutions offer the strongest balance between speed, control, and long-term viability. They are not the cheapest upfront—but they eliminate the hidden long-term costs that destroy most small brokers.

When a Turnkey Model Wins

- A broker wants speed without losing control.

- The team lacks technical engineers.

- The goal is to scale beyond “small white-label stage.”

- The business wants its own liquidity relationships.

- The broker wants to be valued as a full entity, not a reseller.

Turnkey is the “professional choice” in the industry because it gives founders a real brokerage—not a sub-brand.

Understanding the White Label Model

A white label brokerage is essentially a rental of someone else’s infrastructure. The provider owns the server, the liquidity relationships, the bridge, the risk environment, the hosting, the data, and much of the backend. The broker receives:

- a branded MT5/MT4-like webtrader interface

- basic client onboarding

- minimal CRM functionality

- a simplified commission structure

White labels were created for entrepreneurs who want to dip their toes into the market without large capital expenditure. They work well for one specific profile: brokers who want to experiment but have limited budget.

However, white labels introduce constraints that most brokers do not anticipate—often until it’s too late. Because the infrastructure is not theirs, they cannot customize execution, adjust routing logic, build complex risk models, integrate specific PSPs, or expand into new markets with differing compliance structures.

White labels almost always cap growth.

When White Labels Make Sense

- A broker wants to test a market with minimal investment.

- The business expects no more than 100–300 active traders.

- There is no ambition to become regulated or multi-asset.

- The founder wants to minimize upfront commitment.

White label is often described as “training wheels,” and that analogy is accurate. It’s good for learning, not for scaling.

Understanding the In-House Build Model

At the opposite end of the spectrum is the in-house build. This is the path chosen by brokers with significant capital and multi-year horizons, often those aiming for:

- proprietary trading platforms

- deep liquidity aggregation

- custom risk engines

- internal quant tools

- multi-jurisdictional operations

- institutional order flow

This model requires not only money but specialized engineering talent. A fully customized brokerage infrastructure may cost millions and take 12–24 months to build properly. The benefit is absolute control: every component is tailored, owned, audited, and adaptable.

But the trade-off is fierce. In-house infrastructure comes with the highest maintenance burden, the highest technical risk, and the slowest time-to-market. Most start-up brokers who attempt this model run out of capital long before reaching stability.

When In-House Builds Make Sense

- The company is well-funded (seven figures+).

- They want a proprietary platform.

- They need deep data or algorithmic customization.

- They are building for institutional audiences.

For everyone else, this model is usually overkill.

The ROI Comparison: The Truth Behind Cost, Profitability & Scalability

Here is where the differences become real. ROI is the ultimate decision factor, and each model produces a very different financial trajectory.

Below is the second and final table (high strategic value):

| Metric | Turnkey | White Label | In-House Build |

| Launch Speed | 2-3 hours | 2–6 weeks | 12–24 months |

| Upfront Cost | Low | Low | Very high |

| Ongoing Cost | Low | High (markup fees) | Very high |

| Execution Control | High | Very low | Full |

| Risk Control | High | Low | Full |

| Regulatory Compatibility | Strong | Weak | Strong |

| Scalability | High | Low | Very high |

| Long-Term ROI | High | Poor | Variable |

White labels appear cheap but produce the worst ROI due to their long-term constraints and markup costs.

Turnkey solutions win on both short-term and long-term ROI.

In-house builds win only when a broker already has significant scale or institutional strategy.

Operational Reality: What Most Brokers Only Discover Too Late

While cost and speed matter, the operational implications tell the real story.

Turnkey brokers operate within a coherent, unified environment. Their CRM speaks to their platform, their liquidity speaks to their risk engine, their onboarding speaks to compliance, and their execution logic is fully transparent. The brokerage behaves predictably under stress.

White label brokers are subject to the limitations of the provider. They cannot adjust risk logic. They cannot change LPs. They cannot adopt custom PSPs. They cannot alter routing strategies. They cannot fix execution issues. Their infrastructure is someone else’s infrastructure.

In-house brokers get full control—but they also inherit full responsibility. Every bug, every integration failure, every platform update, every server crash is on them. It is a high-risk, high-complexity model that only works with deep pockets and experienced engineering leadership.

Turnkey models strike the operational sweet spot: fast enough to launch quickly, flexible enough to operate seriously, and sophisticated enough to prepare for long-term scale.

The Regulatory Factor (Often Ignored, Always Important)

Regulation changes everything. A white label is almost never eligible for meaningful licensing. Regulators want:

- control over client data

- clear execution reporting

- transparent liquidity arrangements

- risk oversight

- auditable onboarding flows

A broker running on a WL rarely has this.

A turnkey deployment gives them the structure to pursue licensing later.

An in-house environment can achieve regulatory excellence—but at high cost.

Turnkey models provide regulatory optionality—someone can start unregulated and evolve into regulated without rebuilding the entire business.

The Liquidity Factor: Control Determines Profitability

Liquidity is one of the top profit levers for brokers.

This is where model differences become stark.

Turnkey Brokers:

Control their liquidity relationships, bridge logic, slippage, markups, and execution paths. This means they control their own spreads, profitability, and risk exposure.

White Label Brokers:

Cannot choose liquidity. They trade through the provider’s setup, often with:

- wider spreads

- hidden markups

- slower execution

- lower fill rates

Profitability is restricted and opaque.

In-House Brokers:

Have complete control—but also bear full responsibility for maintaining institutional-grade connectivity.

Turnkey wins again:

Better control than WL, far cheaper than in-house.

The Scalability Factor: Which Model Survives Growth?

A brokerage that grows from 200 clients to 3,000 cannot continue operating as if nothing changed. Infrastructure must scale. Support must scale. Execution must scale. Payment rails must scale.

Here’s what happens when growth arrives:

- White Label brokers hit a ceiling immediately.

- Turnkey brokers scale naturally because the stack was built with growth in mind.

- In-House brokers scale, but only with heavy capital injection.

White label often creates a trap: they’re cheap to start, but prohibitively expensive to grow.

Turnkey becomes the best choice for any broker with real growth ambition.

Long-Term ROI Verdict

The true cost of a model includes:

- opportunity cost

- scalability

- client experience

- risk exposure

- operational inefficiency

- regulatory limitations

- execution slippage

- infrastructure failures

When factoring everything, the ROI comparison becomes clear:

White Label → cheapest upfront, worst long-term ROI

Turnkey → best balance of cost, speed, control, & scalability

In-House → strongest for institutions, wasteful for startups

Turnkey aligns with how serious brokers actually operate.

It creates a real business—not a dependency.

Conclusion: The Strategic Choice for Modern Brokers

The brokerage model you choose determines much of your future.

A white label gives cheap access but traps you in someone else’s ecosystem.

An in-house build gives freedom but requires millions and years.

A turnkey solution delivers a functional brokerage, with meaningful control, institutional-grade infrastructure, and a runway for real scale.

This is why Spencer Logic’s turnkey deployment is not simply a product—it is a strategic foundation. It gives founders:

- a credible platform,

- transparent execution,

- full operational workflows,

- scalable architecture,

- regulatory-ready structure,

- and a competitive edge from day one.

Choosing the right model is choosing the future of the business.

Turnkey gives brokers the strongest chance of building something real, sustainable, and competitive.