TL;DR for busy COOs

- Liquidity aggregation is four disciplines working in lockstep: pricing, smart order routing (SOR), risk & controls, and observability. Get all four right to win VIP trust.

- Start with a small symbol pack, run shadow mode, and ramp by health gates (10%→25%→50%→100%).

- Make routing explainable (reason codes, session-aware weights). Your BI should prove outcomes—not a vendor’s black box.

- Track a tight KPI set (fill rate, order-to-ack, slippage/markout, stale-quote ratio). Act on trends, not anecdotes.

By Logic Pulse | Spencer Logic Insights Series

Late on a Sunday open, Client A’s desk saw spreads breathe and pings spike. The front end stayed calm. Quotes held their shape, orders found healthy venues, and VIP tickets got filled without a single “why did it go there?” email. That was not luck; it was a system designed for normalize → price → route → confirm → hedge → report, with guardrails and a paper trail from the very first packet.

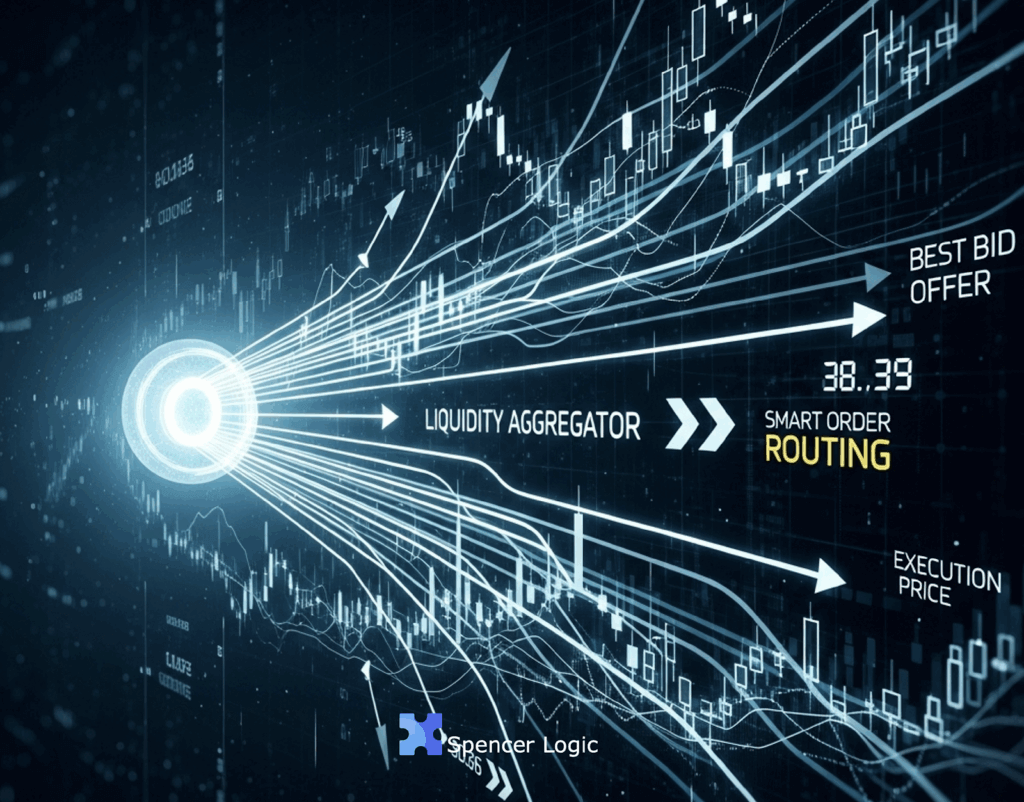

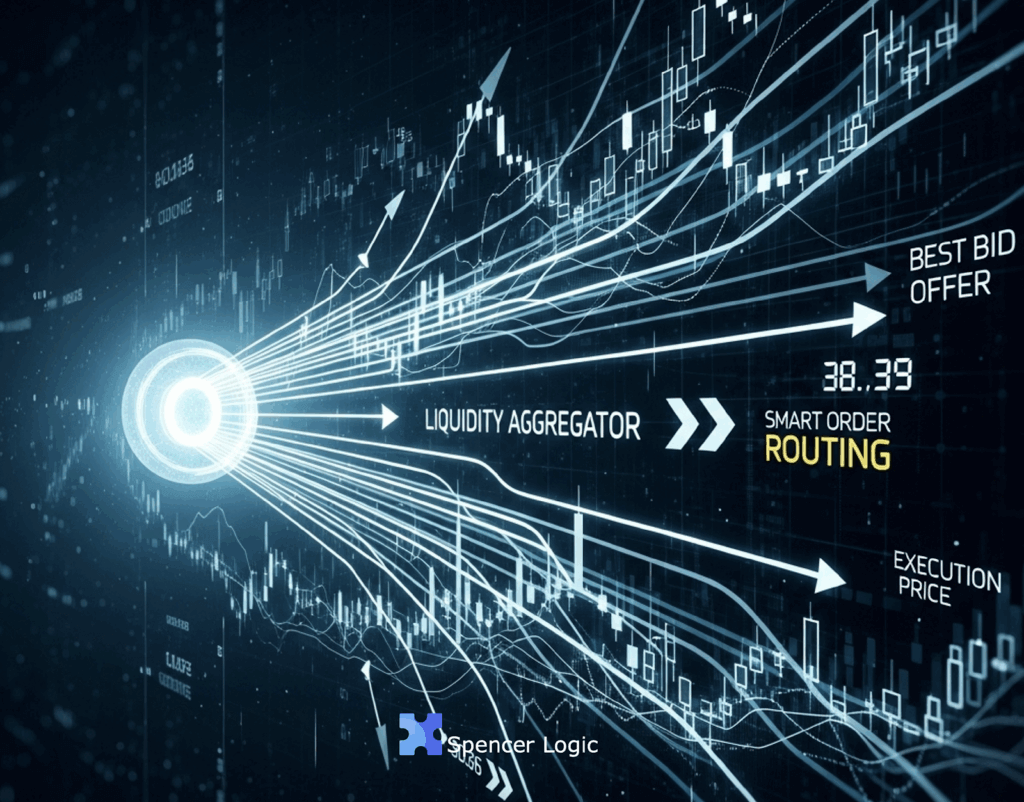

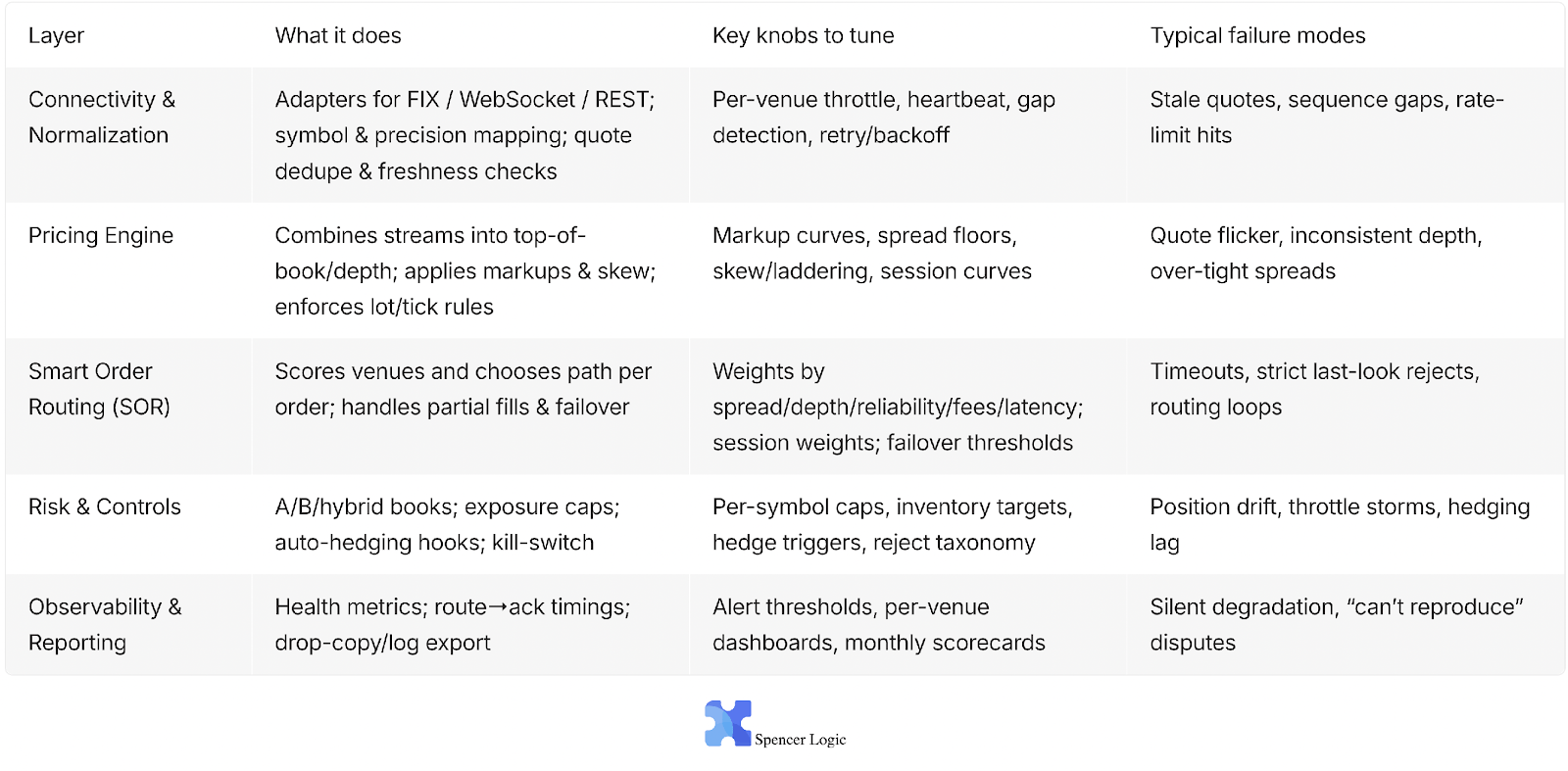

At the heart of this system are three “brains” and one conscience. The pricing engine shapes the quote you show; the SOR chooses the path for each order; risk & controls keep exposure and throttles sane; and observability makes the whole thing legible to business leaders and partners. Below is the stack—clear roles, clear knobs, clear failure modes.

Table 1 — Aggregation stack at a glance

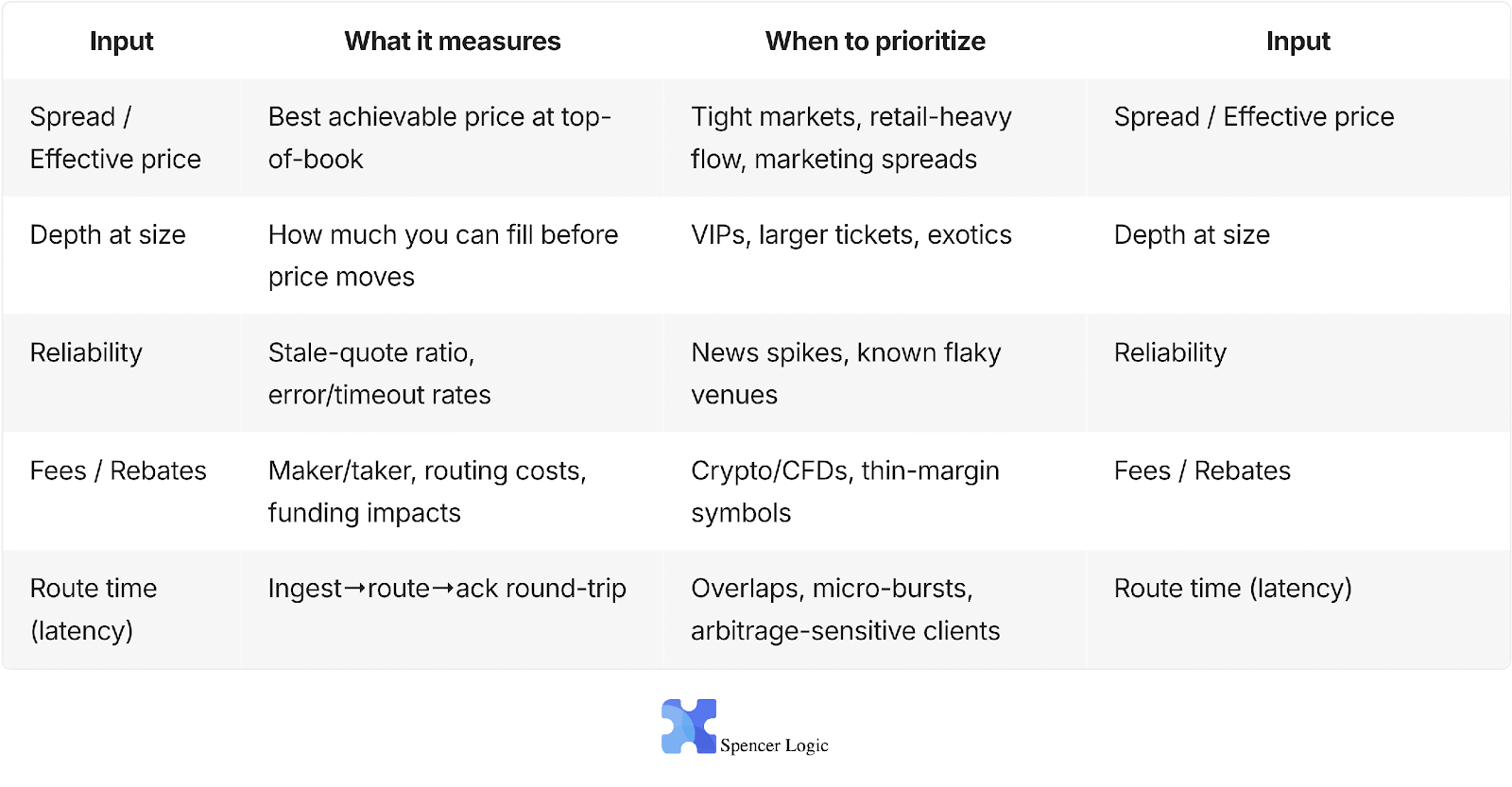

The SOR deserves special attention. It runs a lightweight cost/quality model every time: effective spread, depth at size, venue reliability, fees/rebates, and round-trip route time—tempered by session behavior (Asia/LDN/NY in FX; weekday/weekend in crypto). On prints and micro-bursts, it de-weights streams that start to time out or go stale and fails over pre-emptively. Most importantly, it stays explainable: “Venue X won because spread was tighter, depth met the ticket size, and ack time stayed within threshold.”

Table 2 — SOR inputs and when to prioritize them

The pricing engine isn’t just arithmetic; it’s diplomacy between your book and the market. It consolidates streams into a tradable ladder, applies inventory-aware skew where it truly lowers hedging costs, and keeps spreads realistic with session curves. Watch quote flicker—it punishes conversion without guaranteeing better fills. Start conservative on floors; tighten with data, not bravado.

Risk & controls are the quiet hero. Standardize reject taxonomies so ops can act fast. Keep per-symbol caps visible. Define a kill-switch policy you’ve actually rehearsed. None of this matters if you can’t see it, so wire drop-copy and logs into your BI. That’s how you prove outcomes to VIPs and partners—your numbers, your definitions.

A step-by-step order walk-through

- Normalize: ingest quotes; dedupe; validate freshness & precision.

- Price: build top-of-book & depth; apply markups/skew.

- Score: SOR evaluates venues with current weights & health gates.

- Route: send; handle partial fills; fail over on ack breaches.

- Hedge: apply inventory rules (A-book/hybrid); drop-copy.

- Report: reason codes + timings feed BI KPIs.

Client A — operating like a top-tier broker/exchange

“We started with ten symbols in shadow mode. Within days we had cleaner reason codes, fewer last-look rejects during overlaps, and a measurable drop in order-to-ack. Our monthly scorecard now tells the story for us—no hand-waving.”

— Client A, COO (name withheld)

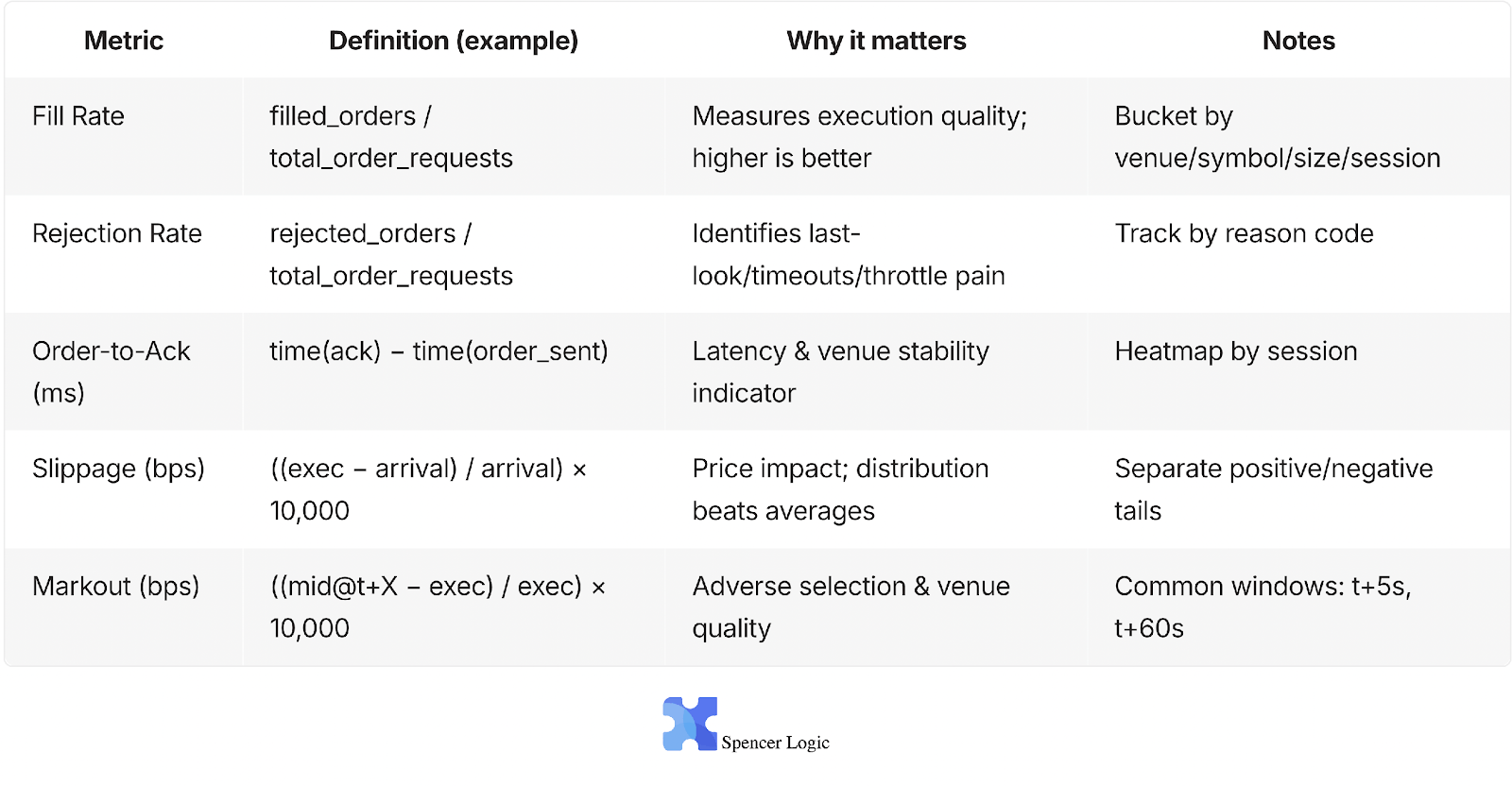

The KPIs that actually move the business

Measure in your existing BI from drop-copy and logs, keep definitions stable, and bucket by venue/symbol/size/session. Then manage the trend lines.

Table 3 — KPI cheat sheet (definitions & why they matter)

How to get live without boiling the ocean

- Normalize reason codes in week one; ambiguity is the enemy of action.

- Add session-aware SOR weights before you micro-tune spread floors.

- Alarm on stale-quote ratio and order-to-ack spikes; these catch most venue incidents early.

- Roll out behind health gates and let your KPI scorecard decide the next 10% of traffic.

Bottom line: COOs don’t need a lecture in microstructure; they need predictability under stress and numbers they can defend. Build for explainability, tune with your BI, and keep the client story simple. Your routing becomes a strategy—not a shrug.